|

|

|

|

|

|

|

|

|

|

Doctors Warn Accountants of Private-Equity Drain on Quality: You Could Be Next

|

|

|

|

|

|

Good morning, CFOs. Medical professionals warn accountants of private-equity firms' influence; the U.S. trade deficit balloons as businesses rushed to stockpile before “Liberation Day” tariffs took effect last month; plus, market jitters over trade are back.

|

|

|

|

|

|

|

|

Boston’s Carney Hospital closed last year after its owner, Steward Health Care, filed for bankruptcy. Steward was formerly private-equity backed. PHOTO: STEVEN SENNE/ASSOCIATED PRESS

|

|

|

|

|

|

Many doctors have decried private-equity firms’ push into healthcare, saying patient care has eroded under their ownership. Now, as these firms make similar inroads in accounting, some medical professionals have a warning for CPA firms: Don’t make our same mistakes.

Drs. Bob McNamara and James Keaney, both former longtime emergency-room physicians, were early critics of private equity in healthcare who now say such ownership in accounting could shake trust in an industry that investors rely on for getting trustworthy financial information about companies.

“If accounting holds itself out as an ethical profession, which puts the client first, they should have never let private equity in because that’s what we did and it hurt the patients,” said McNamara, a professor and chair of emergency medicine at Temple University.

Roughly two dozen of the 100 largest U.S. accounting firms have either sold an ownership stake to private-equity investors or been acquired by a firm that has done so since 2021. The increasingly close ties between private equity and auditors have raised concerns over the potential threat to the independence of auditors, who are intended to be objective assessors of financial information. Accountants worry the typical three- to five-year investment window is detrimental to the CPA firms’ long-term plans for maintaining service quality and could spur them to accept higher-risk clients.

|

|

|

|

|

Content from our sponsor: Deloitte

|

|

|

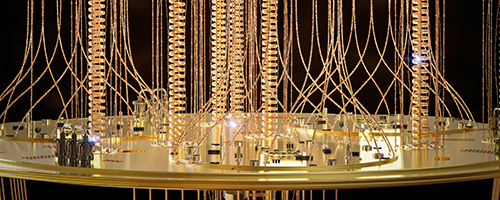

How CFOs Can Prep for Tech Trends in AI Hardware, Talent, and Quantum

|

|

A Tech Trends report details how CFOs can help their organizations unlock business value and increase productivity, while pursuing new avenues for growth and advantage. Read More

|

|

|

|

|

|

|

|

|

|

|

|

📆 Earnings

-

DoorDash

-

Novo Nordisk

-

Occidental Petroleum

-

Uber Technologies

-

Disney

📈 Economic Indicators

The Federal Open Market Committee announces its monetary policy decision.

|

|

|

|

What Else Matters to CFOs

|

|

|

|

|

|

|

The U.S. imported $1 trillion in goods in the first quarter. PHOTO: JULIA DEMAREE NIKHINSON/ASSOCIATED PRESS

|

|

|

|

|

|

The U.S. trade deficit ballooned 14% to a record $140.5 billion in March, as businesses stockpiled goods to get ahead of sweeping tariffs that President Trump imposed the following month.

The value of imported goods totaled $346.8 billion, according to Census Bureau data, continuing a sharp increase that began in January. Nearly all of the $22.5 billion surge in imported consumer goods for March were pharmaceutical products, which the Trump administration is currently considering to hit with tariffs. Imports of computer accessories, automobiles, and car parts and engines also increased.

The rush may be short-lived. Trump announced tariffs on all imported goods on April 2, and ratcheted up his trade war with China. Cargo shipments from China have slowed considerably, with additional tariffs on Chinese goods now pegged at 145%.

“The record has only been a result of front running,” and “the trade deficit should be narrower in April,” said Bradley Saunders, economist at Capital Economics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Wall Street Journal's CFO Journal offers corporate leaders and professionals CFO analysis, advice and commentary to make informed decisions. We cover topics including corporate tax accounting, regulation, capital markets, management and strategy. Follow us on X @WSJCFO. The WSJ CFO Journal Team comprises reporters Kristin Broughton, Mark Maurer and Jennifer Williams, and Bureau Chief Walden Siew. You can reach us by replying to any newsletter, or email Walden at walden.siew@wsj.com.

|

|

|

|

|

|