Also, ‘tie-one’ of these ETFs on for size

MarketWatch illustration/iStockphoto

If ETF Wrap had a list of New Year’s resolutions, top among them would be to banish 2020isms like “unprecedented” and “pivot” from our vocabulary.

Also: no more cute names for market churn that ultimately goes nowhere. (Earlier in the fall, we compared it to cats watching Wimbledon, last week we called it “zigzagging,” the week before, “pingponging.”)

What we do pledge to do is continue bringing fresh content about ETFs: new launches, interesting strategies, industry profiles, and much more.

This will be the last Wrap of 2020 — a year that really will live in infamy.

Happy holidays, thanks for reading, and stay warm and healthy!

Every year, portfolio strategist Astoria Advisors publishes a report on its picks for the top 10 ETFs for the coming year. Founder John Davi was also brave enough to share with MarketWatch a reminder of his report from last year: that is, the firm’s calls for 2020.

Even though the world went upside-down in 2020, some of Astoria’s calls made out well, such as the iShares MSCI China ETF MCHI, which has gained 24.5% in the year to date, and the VanEck Vectors Gold Miners ETF GDX, which is up 22.7%, as of Wednesday’s close. But there were some misses as well: the Invesco KBW Bank ETF KBWB is down 14.7%, and the SPDR S&P Emerging Markets Dividend ETF EDIV has lost 14.5%.

Yes, it was a tough year to forecast – but that’s the risk you take when you publish a forecast. And Davi is a big believer in strategic asset allocation, not high-frequency trading, as he told MarketWatch in October.

For 2021, Astoria is betting on commodity equity ETFs, healthcare, cyclical growth funds, clean energy, and more. The full report can be found here and several of the firm’s specific picks are below.

There are plenty of good reasons to consider investing in

emerging markets now – and one particularly promising way to do it.

“Taiwan is more important than ever from an investment

standpoint and a strategic one,” said Perth Tolle, founder of the Freedom 100 Emerging Markets ETF. “Its location

makes it geographically important for the US in case anything happens in the South

China Sea. It’s ideologically important because it’s a country made up of

Chinese people that is also a successful democracy. And it is the world leader

in industries that are strategically important for our supply chain – in particular

semiconductors.”

MarketWatch profiled Tolle’s ETF, often referred to by its ticker, FRDM, when it launched in 2019. At the time, we called it perhaps “the ultimate example of trying to do well financially by doing good,” recognizing that its investment thesis – that countries committed to human and economic freedoms will enjoy more favorable financial returns over time – may sound Pollyannaish.

Yet it’s been borne out this year, especially, as Tolle said

in an interview, “in contrast to the elephant in the room, China.”

Taiwan is a far freer economy and society than China, she points out, and that’s translated into returns through the 2020 recovery. Since the March 23 low, the iShares MSCI Taiwan ETF EWT has gained 71%, trouncing the 55% return for the Xtrackers Harvest CSI 300 China A-Shares ETFASHR.

“In a recovery especially you want to be in the freer markets,”

Tolle said. “They are more flexible and more innovative and can respond to

market trends faster.”

The longer-term decoupling from China that’s likely to continue under a Biden administration is also to Taiwan’s benefit. And Tolle thinks that even as China grows more bellicose toward Taiwan, ultimately it’s just hot air.

FRDM has 26% of its portfolio allocated to Taiwanese companies, with Taiwan SemiconductorTSM as its largest single holding. It has gained 12.1% in the year to date, just trailing the 14.2% return for the S&P 500 – but in the last three months, has surged 26.2%.

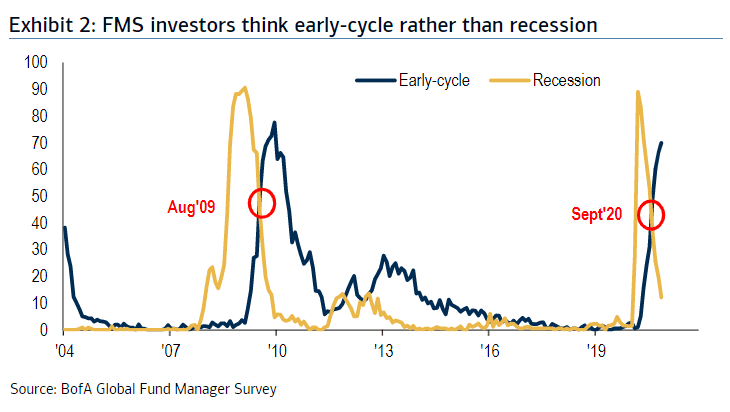

Many more investors say the global economy is in an early-cycle phase (70%, highest since January 2010) as opposed to recession (12%), which as seen in 2009 & 2012 is a key recovery milestone. <br>

Editor’s note: MarketWatch has adjusted the parameters of the FactSet screen used to calculate our weekly gainers, losers, and inflows. We hope the new methodology will offer a more complete view of the ETF market.

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.