November 2022 - All data sourced from CME; Statistics Canada.

No images? Click here

Canada’s Trade Balance Swings into Deficit in November, as Both Exports and Imports Fall

HIGHLIGHTS

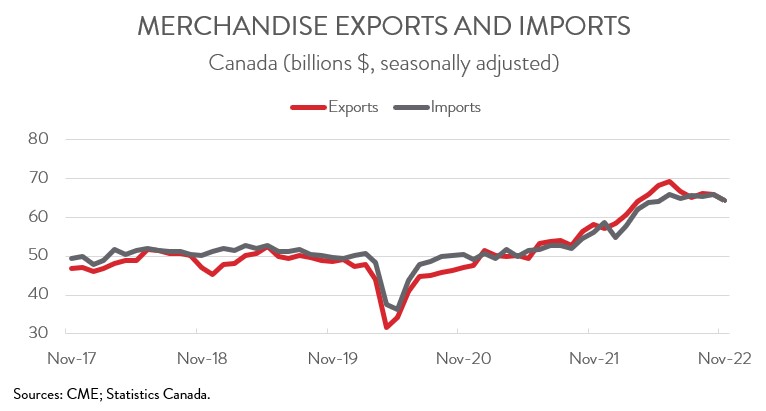

- Merchandise exports declined 2.3% to $64.4 billion in November, while merchandise imports fell 2.1% to $64.4 billion.

- Canada’s merchandise trade balanced moved from a surplus of $130 million in October to a modest deficit of $41 million in November.

- In real or volume terms, exports and imports were down 1.5% and 0.7%, respectively.

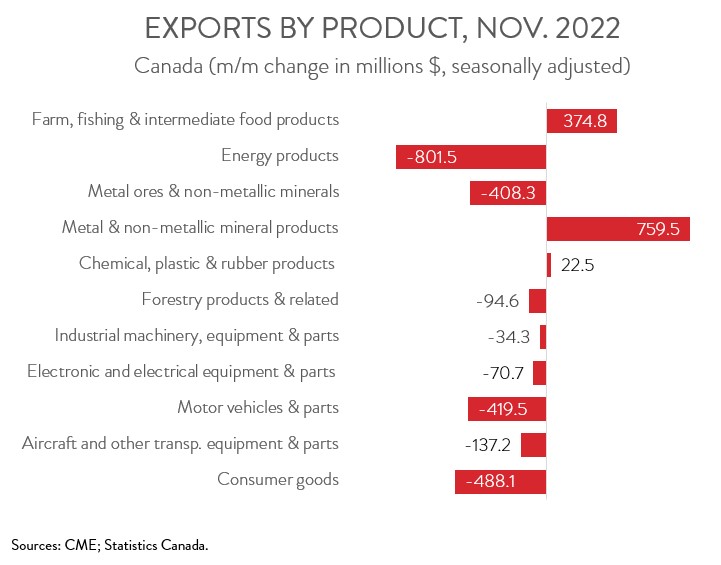

- The decrease in nominal exports spanned 8 of 11 product sections, with energy products, consumer goods, and motor vehicle and parts contributing the most to the decline.

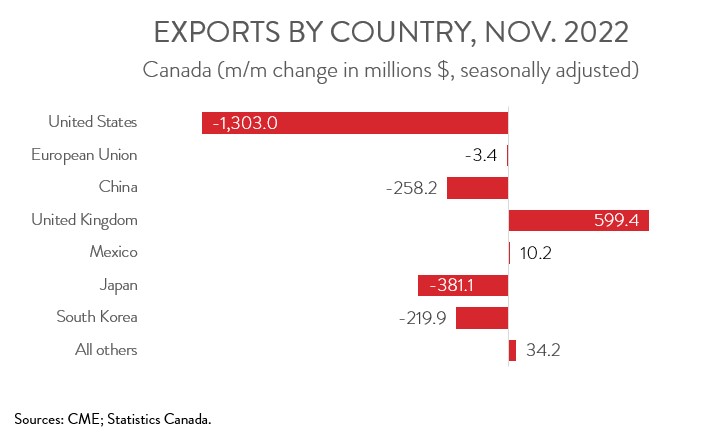

- Exports to the U.S. decreased 2.6% to $48.2 billion in November, while exports to the rest of the world dropped 1.3% to $16.2 billion.

- While November’s decline in nominal exports largely reflected lower energy prices, a stronger dollar, and a few one-off factors, the drop in import and export volumes could stem from weakening domestic and global demand.

EXPORT AND IMPORT VALUES AND VOLUMES DROP IN NOVEMBER

Merchandise exports declined 2.3% to $64.4 billion in November, while merchandise imports fell 2.1% to $64.4 billion. In real or volume terms, the picture was similarly downbeat, with exports and imports down 1.5% and 0.7%, respectively.

While a depreciating Canadian dollar has provided a lift to trade activity in recent months, a stronger loonie put downward pressure on trade values in November. Indeed, when expressed in U.S. dollars, Canadian exports and imports were down a much more modest 0.5% and 0.2%, respectively, in the penultimate month of 2022.

While November’s decline in nominal exports largely reflected lower energy prices, a stronger dollar, and a few one-off factors, the drop in import and export volumes could stem from weakening domestic and global demand.

CANADA POSTS MODEST TRADE DEFICIT

Canada’s merchandise trade balanced moved from a surplus of $130 million in October to a modest deficit of $41 million in November. Breaking these data down, our trade surplus with the U.S. narrowed for the sixth consecutive month, moving from $8.6 billion in October to $7.3 billion in November. At the same time, our trade deficit with the rest of the world narrowed from $8.4 billion to $7.3 billion.

EXPORT DECLINE WIDESPREAD ACROSS PRODUCT SECTIONS

The decrease in exports was widespread, spanning 8 of 11 product sections. Exports of energy products fell 4.7% to $16.3 billion, the fifth consecutive monthly decline. Notable drops were observed in several sub-categories, including in coal, natural gas, crude oil and bitumen, and refined petroleum energy products.

Exports of consumer goods decreased 6.3% to $7.2 billion in November, largely erasing the previous month’s gains. The decline was broad-based across the product section, with the most pronounced drops coming in pharmaceutical and medicinal products and meat products.

Motor vehicle and parts exports fell 6.4% to $6.1 billion in November, down for the third time in four months. Statistics Canada attributed the decrease to a sharp drop in exports of engines and parts that coincided with lower U.S. auto production.

Finally, exports of metal ores and non-metallic minerals decreased 13.3% to $2.7 billion in November. Most notably, exports of copper ores and concentrates fell to their lowest level since April 2011, due in large part to shipping delays. But given that these delays are temporary, exports from this subsector will likely rebound in the coming months.

On the positive side, metal and non-mineral products exports jumped 11.9% to $7.2 billion in November, largely offsetting the sharp decline observed in the previous month. The increase was driven by higher exports of unwrought gold, silver and platinum group metals and their alloys.

As well, exports of farm, fishing, and intermediate products increased 6.7% to an all-time high of $ 5.9 billion in November. Agricultural exports have increased by an impressive 42.5% over the last six months, attributable to last year’s bumper crop, strong global demand, and high prices.

EXPORTS TO THE U.S. FALL FOR THE FIFTH STRAIGHT MONTH

Exports to the U.S. declined 2.6% to $48.2 billion in November, down for the fifth consecutive month. At the same time, exports to the rest of the world fell 1.3% to $16.2 billion. Among Canada’s major non-U.S. trading partners, exports to Japan, China, South Korea, and the EU were down, while exports to the U.K. and Mexico were up. The decrease in exports to China was driven by lower exports of copper, wheat, and pulse crops, while the decrease in exports to South Korea was propelled by iron ores and copper ores.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters.

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.