July 2023 - All data sourced from CME; Statistics Canada.

No images? Click here

BC Port Strike Weighs on Trade Activity, Though Exports Still Eke Out Modest Gain

HIGHLIGHTS

- Canada’s merchandise exports edged up 0.7% to $60.4 billion in July, while imports plunged 5.4% to $61.4 billion.

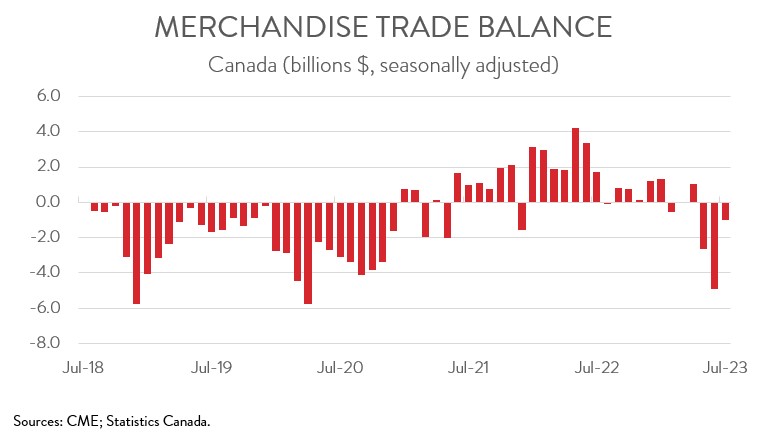

- The country posted a trade deficit of $987 million in July compared with a deficit of $4.9 billion in June.

- On a volume basis, exports were up 0.2% and imports were down 4.9%.

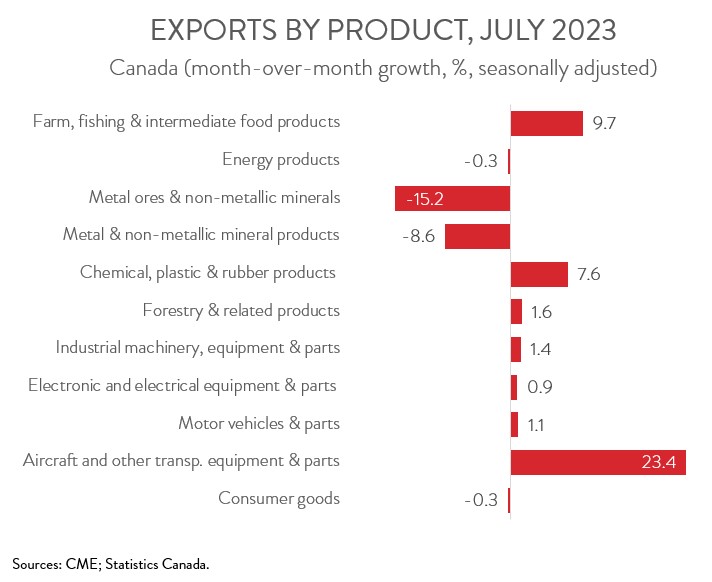

- The increase in nominal exports spanned 7 of 11 product sections, with higher exports of aircraft and canola more than offsetting lower exports of unwrought gold.

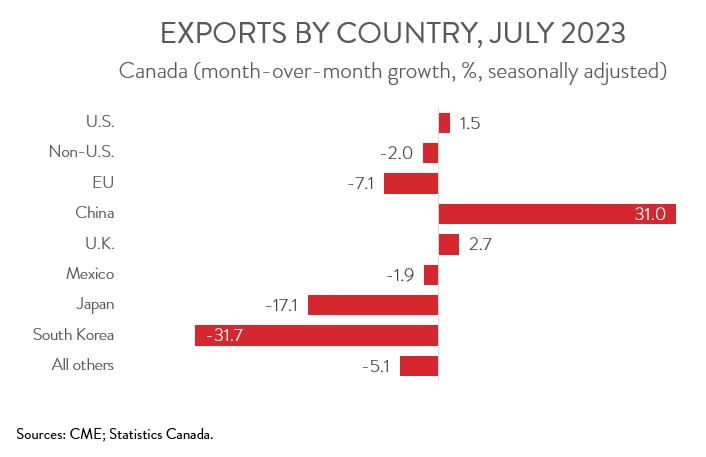

- Exports to the U.S. rose 1.5% to $47.4 billion in July, while exports to the rest of the world contracted 2.0% to $13.0 billion.

- The B.C. port strike weighed on trade activity in July, bolstering CME’s position that Canada’s ports and railways need to be designated as critical infrastructure to prevent these types of shutdowns in the future.

EXPORTS POST FIRST GAIN IN THREE MONTHS

Canada’s merchandise exports edged up 0.7% to $60.4 billion in July, the first gain in three months. In contrast, merchandise imports plunged 5.4% to $61.4 billion in July, down for the first time in three months. On a volume basis, exports were up 0.2% and imports were down 4.9%.

The B.C. port strike weighed on trade activity in July. According to Statistics Canada, customs-basis exports leaving B.C. marine ports fell 23.0% month-over-month in July, falling to their lowest level since February 2020. At the same time, imports that were cleared in B.C. marine ports plunged 18.5%. These data bolster CME’s position that Canada’s ports and railways need to be designated as critical infrastructure to prevent these types of shutdowns in the future.

Fortunately, real exports got off to a better start than expected in the third quarter, providing some hope that net trade could keep overall GDP growth in positive territory in Q3. On the downside, export activity is expected to remain subdued over the near-term amid a slowing global economy.

CANADA’S TRADE DEFICIT NARROWS

Canada’s trade narrowed to $987 million in July from $4.9 billion in June. Breaking the numbers down, Canada’s trade surplus with the U.S. widened from $6.4 billion in June to $7.4 billion in July, while our trade deficit with the rest of the world narrowed from a record high of $11.4 billion to $8.4 billion.

EXPORT INCREASE DRIVEN BY AIRCRAFT AND CANOLA

The increase in exports spanned 7 of 11 product sections. Exports of aircraft and other transportation equipment and parts surged 23.4% to $3.2 billion. Aircraft exports, which nearly doubled, contributed the most to the increase.

Exports of farm, fishing and intermediate food products increased 9.7% to $4.6 billion in July, up for the first time in five months. Canola exports more than doubled, helped by the fact that operations at B.C. grain terminals were unaffected by the strike.

On the negative side, exports of metal and non-metallic mineral products dropped 8.6% to $6.6 billion in July, down for the third month in a row. The decrease was largely attributable to lower exports of unwrought gold, which fell for the third consecutive month after reaching a record high in April.

EXPORTS TO U.S. SEE FIRST INCREASE IN THREE MONTHS

Exports to the U.S. rose 1.5% to $47.4 billion in July, up for the first time in three months. At the same time, exports to the rest of the world contracted 2.0% to $13.0 billion. Among Canada’s major non-U.S. trading partners, exports to China and the U.K. were up, while exports to Japan, the EU, South Korea, and Mexico were down. The increase in exports to China was driven by canola and wheat, while the decrease in exports to the EU was partly attributable to lower exports of pharmaceutical products and crude oil to Italy.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters.

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.