Manufacturing Sales – October 2022

No images? Click here

Factory Sales Post Solid Increase in October, Thanks to Higher Prices

HIGHLIGHTS

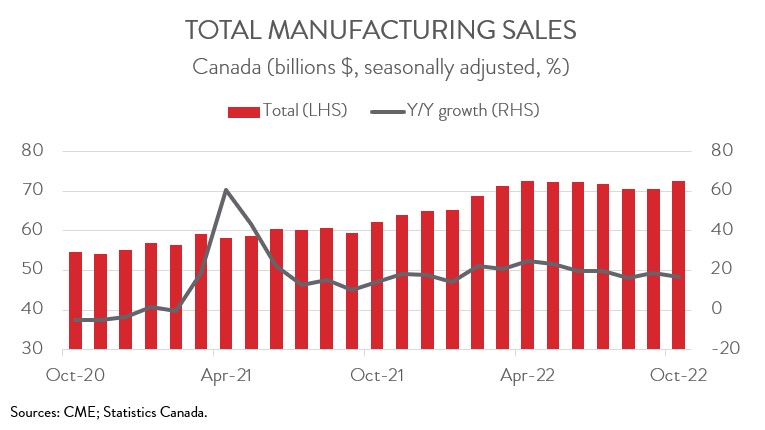

- Manufacturing sales rose 2.8% to $72.6 billion in October, the first solid increase in six months.

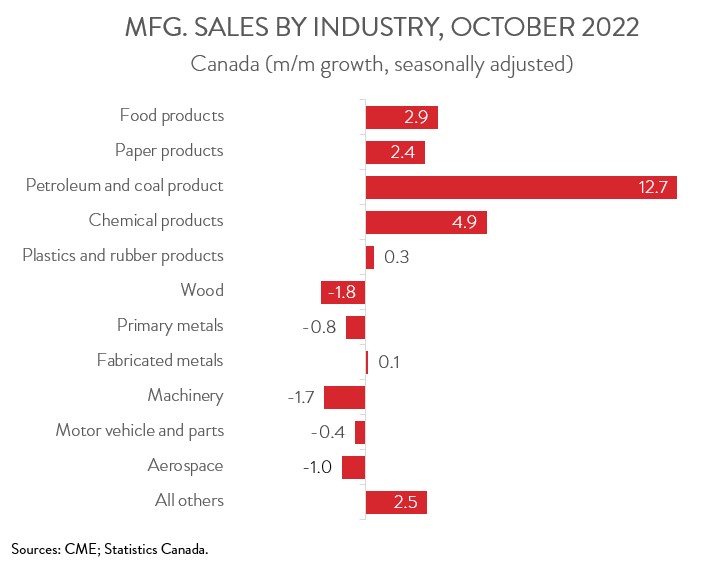

- Sales were up in 6 of 11 major industries, with the petroleum and coal product, food, and chemical industries contributing the most to the growth.

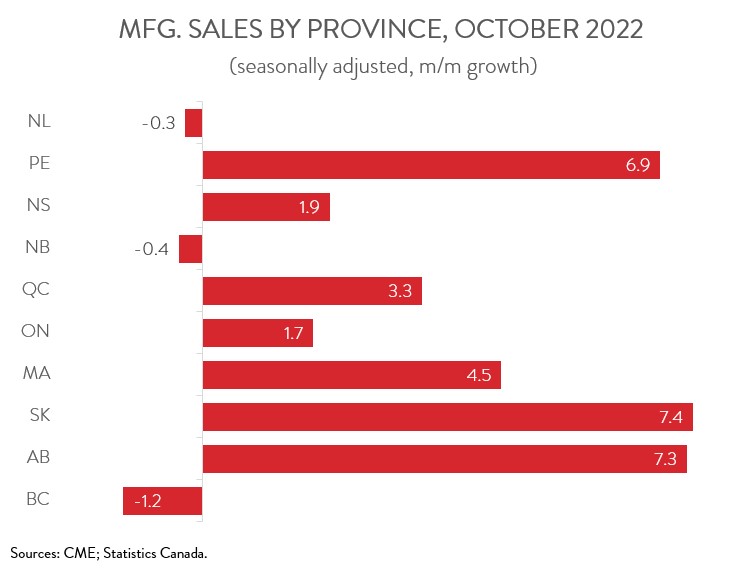

- Regionally, sales increased in 7 of 10 provinces, led by Alberta, Quebec, and Ontario.

- The inventory-to-sales ratio decreased from 1.73 in September to 1.68 in October, down for the first time in seven months.

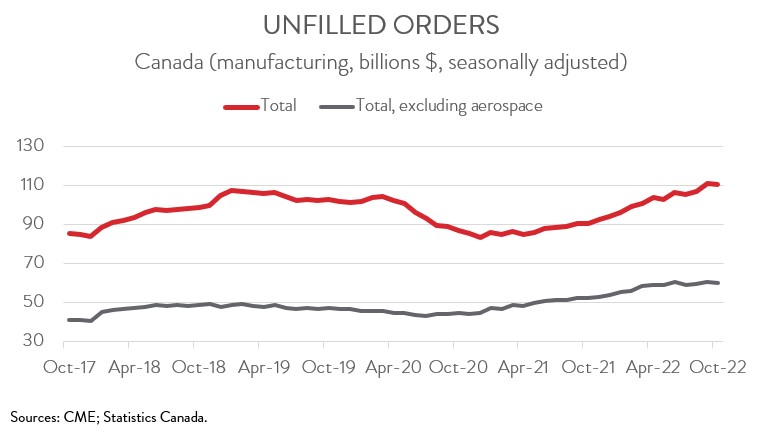

- Forward-looking indictors were soft, with unfilled orders unchanged and new orders down 2.7%.

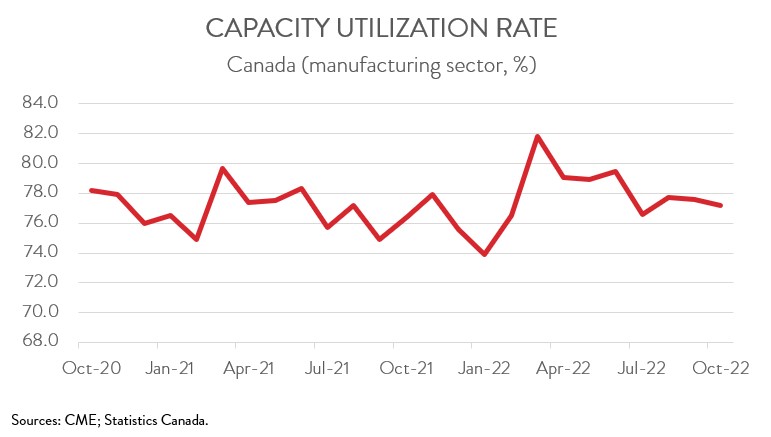

- The manufacturing sector’s capacity utilization rate edged down from 77.6% in September to 77.2% in October.

- While today’s report featured a strong headline number, it masked underlying softness. Constant dollar sales were flat on the month, continuing a string of weak readings for this key indicator. In fact, real sales have declined by 2.4% since May 2022, suggesting that Canada’s manufacturing sector is feeling the pinch of slowing economic growth both at home and globally.

MANUFACTURING SALES UP 2.8% IN OCTOBER

Manufacturing sales rose 2.8% to $72.6 billion in October, the first solid increase in six months. Sales in constant dollars were unchanged, indicating that the entire increase in current dollar sales was driven by higher prices.

While today’s report featured a strong headline number, it masked underlying softness. With constant dollar sales flat on the month, it continued a string of weak readings for this key indicator. In fact, real sales have declined by 2.4% since May 2022, suggesting that Canada’s manufacturing sector is feeling the pinch of slowing economic growth both at home and globally. This is on top of existing problems the industry is already facing, including labour shortages, disrupted supply chains, and high production costs.

MIXED INDUSTRIAL PERFORMANCE

Sales increased in 6 of 11 major industries in October. After four consecutive monthly declines, sales in the petroleum and coal product industry jumped 12.7% to $10.6 billion in October. The growth was largely due to higher prices, though volumes were up somewhat too.

Food sales climbed 2.9% to an all-time high of $12.3 billion in October. The gains were predominately driven by the grain and oilseed milling industry, a sector that has seen prices and global demand for their products soar since Russia invaded Ukraine.

Factory sales in the chemical industry were up for the second straight month, rising 4.9% to $6.1 billion in October. The gain was mainly attributable to the pesticide, fertilizer and other agricultural industry, coinciding with strong seasonal demand and worldwide supply shortages due to sanctions aimed at Russia and Belarus.

On the negative side, sales of machinery fell 1.7% to $4.2 billion in October, down for the third time in four months. At the same time, sales of wood products decreased 1.8% to $3.6 billion, the seventh consecutive monthly decline, attributable to rising interest rates and slower North American housing market activity. Finally, sales of motor vehicles and parts edged down 0.4% to $6.6 billion in October, as a lack of materials and semiconductor shortages continue to plague several auto manufacturers.

ALBERTA, QUEBEC, AND ONTARIO SEE BIGGEST GAINS

Regionally, sales were up in seven of ten provinces in October. Alberta posted the strongest gains, with sales rising 7.3% to a record high of $9.5 billion, led by the petroleum and coal product and chemical industries. Sales in Quebec climbed 3.3% to $18.2 billion in October, as higher sales in the petroleum and coal product and paper product industries more than offset lower sales in the wood product sector. Following a 1.0% decline in September, sales in Ontario increased 1.7% to $31.1 billion in October, as higher sales in the petroleum and coal product and miscellaneous manufacturing sectors more than made up for lower sales of motor vehicles.

On the flipside, sales in BC fell 1.2% to $5.7 billion in October, down for the sixth time in seven months and mainly driven by the primary metal industry. New Brunswick and Newfoundland and Labrador also saw factory sales shrink in October, though the declines were relatively modest at 0.4% and 0.3%, respectively.

INVENTORY-TO-SALES RATIO FALLS FOR FIRST TIME IN SEVEN MONTHS

Total inventories climbed to yet another record high, increasing 0.3% to $122.2 billion in October, the 22nd consecutive monthly increase. But with sales rising at an even faster pace, the inventory-to-sales ratio decreased from 1.73 in September to 1.68 in October, down for the first time in seven months. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS SOFT

Forward-looking indictors were soft. The total value of unfilled orders remained unchanged at $110.9 billion in October, as higher unfilled orders in the aerospace product and parts and fabricated metal industries were counterbalanced by lower unfilled orders in the computer and electronic product and primary metal industries.

At the same time, the total value of new orders decreased 2.7% to $72.5 billion, as lower new orders in the transportation equipment industry more than offset higher new orders in the petroleum and coal product sector.

CAPACITY UTILIZATION RATE EDGES DOWN

Finally, the manufacturing sector’s capacity utilization rate edged down from 77.6% in September to 77.2% in October. The primary metal, computer and electronic, and transportation equipment sectors experienced the most significant declines, while the petroleum and coal product and chemical industries posted the most notable increases.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.