Manufacturing Sales – February 2023

No images? Click here

Factory Sales Pull Back in February

HIGHLIGHTS

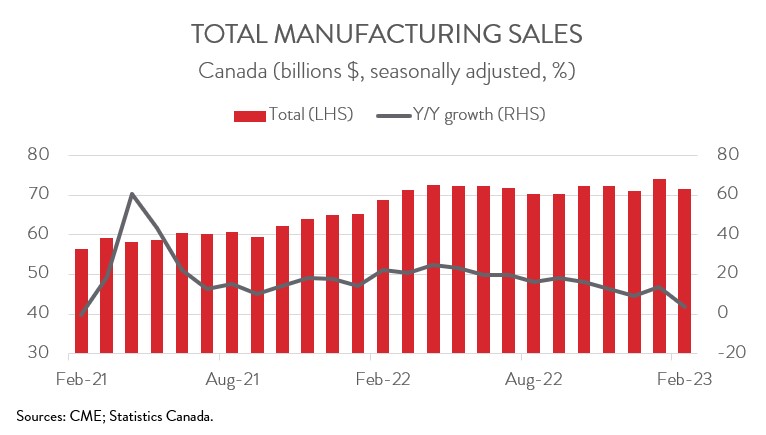

- Manufacturing sales declined 3.6% to $71.5 billion in February, following a 4.5% increase in January.

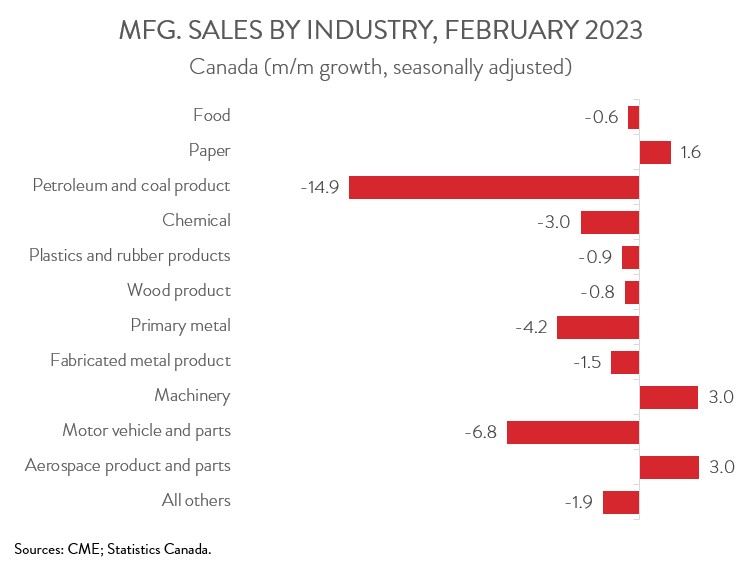

- Sales were down in 8 of 11 major industries, with the petroleum and coal product, motor vehicle and parts, and primary metal industries taking the biggest hits.

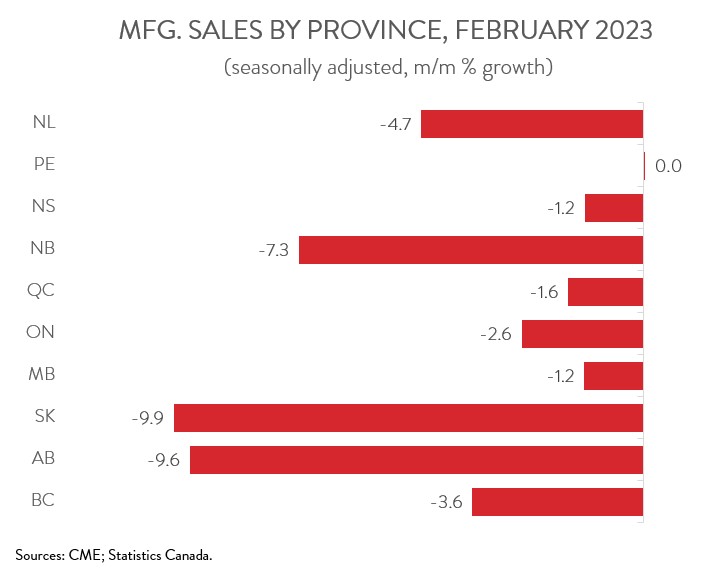

- Regionally, sales fell in 9 of 10 provinces, led by Alberta, Ontario, and Quebec.

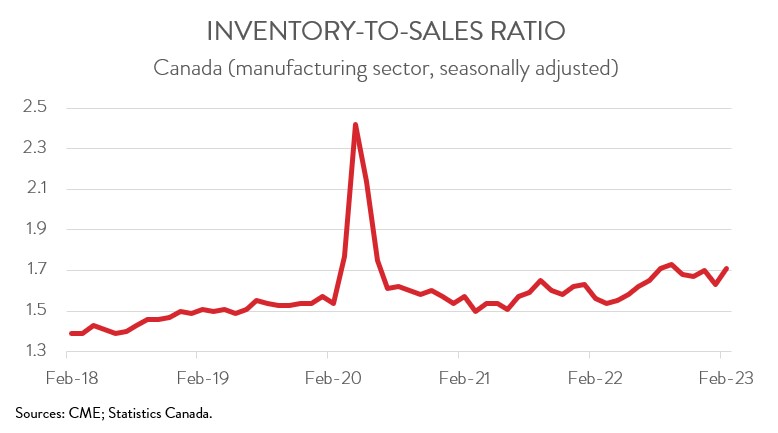

- The inventory-to-sales ratio increased from 1.63 in January to 1.71 in February.

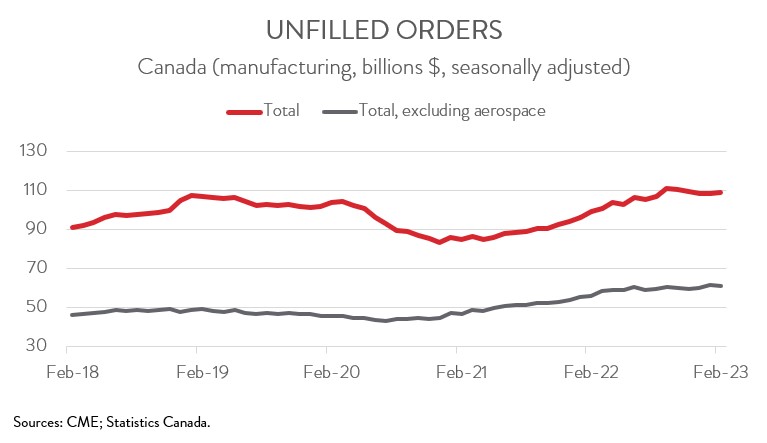

- Forward-looking indictors were mixed, with unfilled orders up 0.6% and new orders down 2.7%.

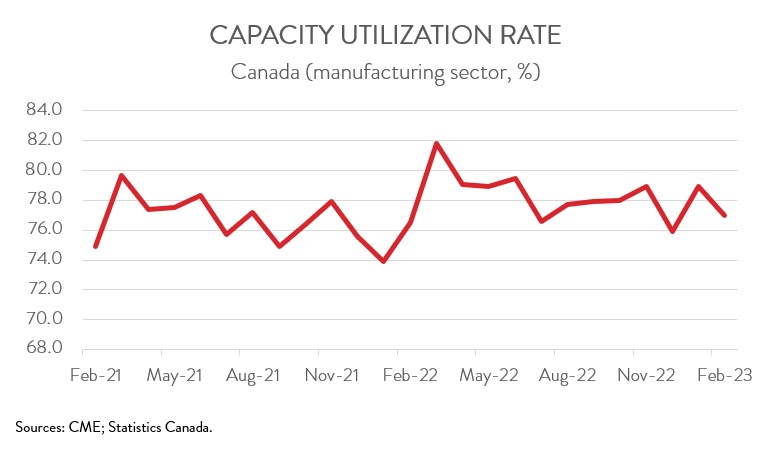

- The manufacturing sector’s capacity utilization rate decreased from 78.9% in January to 77.0% in February.

- Today’s report provides further evidence that Canada’s manufacturing sector is struggling to gain traction amid a challenging global economic environment characterized by a sharp rise in borrowing costs, the pandemic’s aftereffects, and geopolitical conflicts.

MANUFACTURING SALES SLUMP 3.6% IN FEBRUARY

Manufacturing sales declined 3.6% to $71.5 billion in February, following a 4.5% increase in January. In real terms, the picture was similarly downbeat, with sales in constant dollars down 2.4%, the largest decline since September 2021.

Today’s report provides further evidence that Canada’s manufacturing sector is struggling to gain traction amid a challenging global economic environment characterized by a sharp rise in borrowing costs, the pandemic’s aftereffects, and geopolitical conflicts.

PETROLEUM AND COAL PRODUCT AND AUTO INDUSTRIES POST BIG DECLINES

Sales decreased in 8 of 11 major industries in February. Following strong growth in January, sales of petroleum and coal products fell 14.9% to $8.8 billion in February, the third-largest monthly decline on record. Sales of refined petroleum products were especially weak, driven down by maintenance-related shutdowns and lower demand for heating fuel amid mild weather in most of Europe and the US.

Sales of motor vehicles and parts decreased 6.8% to $7.7 billion in February, down for the first time in five months. As has been the case since late 2020, the decline was attributable to reduced production associated with insufficient supply of chips and materials. Despite the monthly decrease, auto sector sales were up 16.1% on a year-over-year basis in February, an indication that the global microchip shortage is slowly improving.

At the same time, sales in the primary metal industry decreased 4.2% to $5.6 billion in February, erasing all the gains made in January. The decline spanned all five subsectors, with the non-ferrous metal (except aluminum) production and processing industry taking the biggest hit. Over the past year, primary metal sales have fallen 1.0%.

On a brighter note, machinery sales increased for the fourth straight month, rising 3.0% to a record high of $4.6 billion in February. The gain was broad-based and led by the industrial machinery manufacturing subsector. Year-over-year, machinery sales were up an impressive 20.0% in February.

SALES DECLINE WIDESPREAD ACROSS PROVINCES

Regionally, sales were down in 9 of 10 provinces in February. Sales in Alberta decreased the most, down 9.6% to $8.8 billion, owing largely to lower sales of petroleum and coal products and chemicals. Ontario also had a tough month, with sales falling 2.6% to $31.8 billion in February, mainly on lower sales in the motor vehicle, petroleum and coal product, and primary metal industries. At the same time, sales in Quebec decreased 1.6% to $17.7 billion in February, as lower sales in the transportation and petroleum and coal product sectors more than offset higher sales in the chemical and machinery industries.

PEI was the only province to buck the trend, with sales holding steady at $273.7 million in February, as higher sales of durable goods were completely offset by lower sales of non-durable goods. On a year-over-year basis, factory sales in PEI were up 23.7%, fastest among all the provinces.

INVENTORIES CLIMB TO A NEW ALL-TIME HIGH

Total inventories rose 0.9% to a new record high of $122.3 billion in February, with the petroleum and coal product, aerospace product and parts, and chemical industries posting the largest gains. As a result, the inventory-to-sales ratio increased from 1.63 in January to 1.71 in February, its highest reading since August 2022. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS MIXED

Forward-looking indictors were mixed. After falling for three consecutive months, the total value of unfilled orders rose 0.6% to $109.1 billion in February. The increase was driven by the aerospace product and parts, other transportation equipment, and railroad rolling stock industries.

In contrast, the total value of new orders decreased 2.7% to $72.2 billion, down for the fourth time in five months. The petroleum and coal product and motor vehicle industries contributed the most to the decline.

CAPACITY UTILIZATION RATE FALLS

Finally, the manufacturing sector’s capacity utilization rate fell from 78.9% in January to 77.0% in February. The petroleum and coal product, transportation equipment, and primary metal sectors recorded the most significant declines, while the machinery industry experienced the most noteworthy advance.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.