Labour Market Trends - May 2023; Sources: CME; Statistics Canada.

No images? Click here

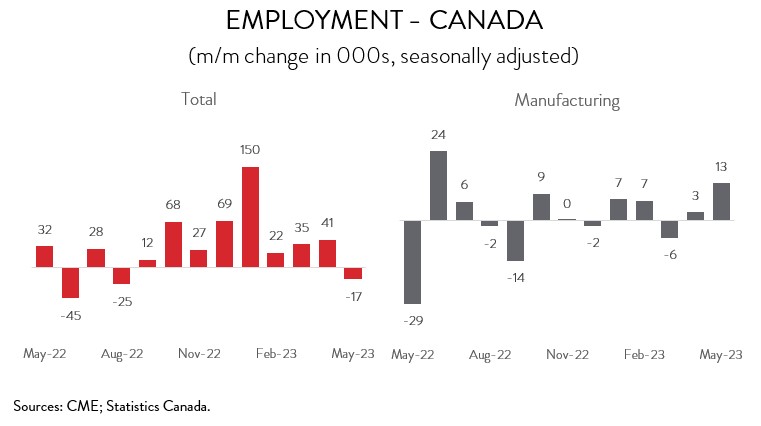

Canada Sheds 17,300 Jobs in May, but Manufacturing Employment Sees Solid Gain

HIGHLIGHTS

- Employment in Canada fell by 17,300 (-0.1%) in May, the first decline in nine months.

- Employment was down in 6 of 16 industries, with building, business and other support services experiencing the biggest decline.

- Manufacturing employment climbed by 12,900 (+0.7%) in May, the biggest monthly gain since June 2022 and surpassing 1.8 million for the first time since January 2018.

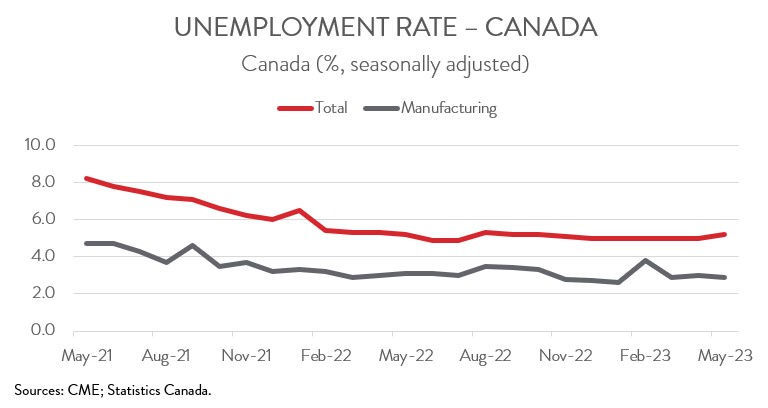

- The headline unemployment rate rose 0.2 percentage points to 5.2% in May, while the jobless rate in manufacturing moved down one tick to 2.9%.

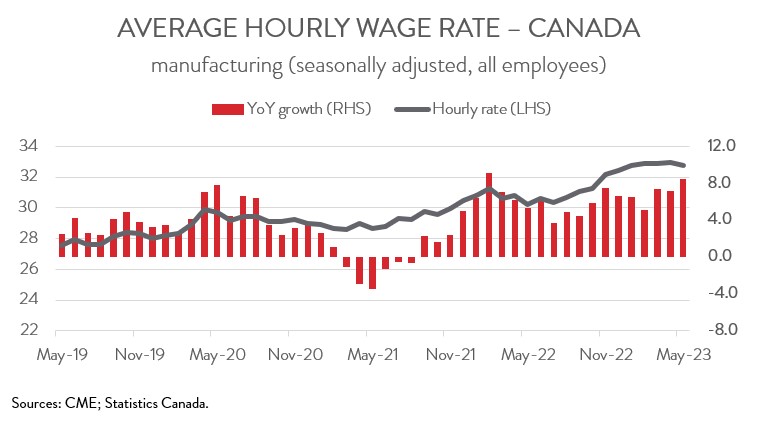

- Although wages in the manufacturing sector posted their biggest monthly drop since July 2022, falling 0.7% in May, they were still up a whopping 8.5% from a year ago.

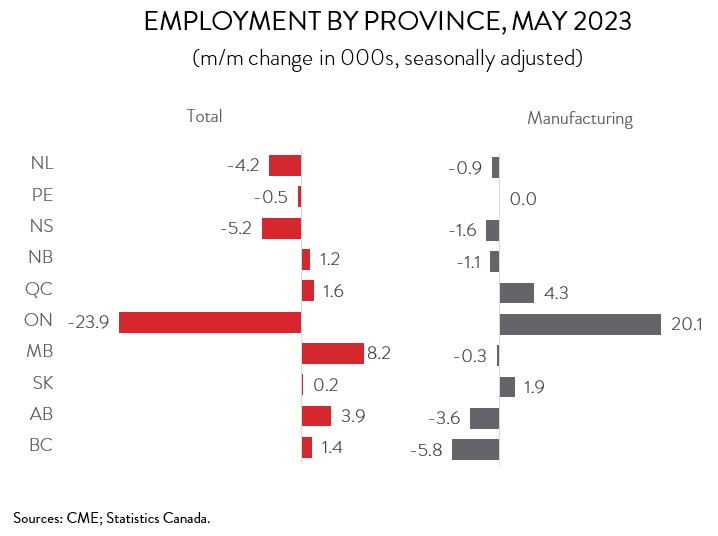

- Total employment was down in 4 of 10 provinces, led by Ontario, Nova Scotia, and Newfoundland and Labrador. In contrast, Ontario was responsible for the bulk of the job gains in manufacturing.

- With the Bank of Canada aggressively hiking interest rates to tackle high inflation, including a surprise 25 basis-point increase on June 7th, it is inevitable that the labour market will eventually cool.

EMPLOYMENT FALLS FOR FIRST TIME SINCE AUGUST 2022

Employment in Canada fell by 17,300 (-0.1%) in May, down for the first time in nine months. Full-time employment drove the decline (-32,700), while part-time work was up slightly (+15,500). It is also worth noting that much of the weakness was confined to youth employment, with Statistics Canada suggesting that students saw a slow start to the summer job season.

Employment was down in 6 of 16 industries in May, led by business, building and other support services (-31,100), professional, scientific and technical services (-13,400), and wholesale and retail trade (-12,900). Besides manufacturing (see below), the largest increases in headcounts were in other services (+11,000) and accommodation and food services (+10,600).

The bottom line is that with the Bank of Canada aggressively hiking interest rates to tackle high inflation, including a surprise 25 basis-point increase on June 7th, it is inevitable that the labour market will eventually cool.

MANUFACTURING EMPLOYMENT SURPASSES 1.8 MILLION FOR FIRST TIME SINCE JANUARY 2018

Manufacturing employment climbed by 12,900 (+0.7%) in May, tops among all industries, and the biggest monthly gain since June 2022. With this increase, employment stood at 1.81 million in May, surpassing 1.8 million for the first time since January 2018. However, despite this obvious good news, the manufacturing sector still faces several headwinds that will likely limit job creation over the near term, including ongoing labour and skills shortages and a slowing global economy.

MANUFACTURING UNEMPLOYMENT RATE TICKS DOWN

After holding steady at 5.0% for five consecutive months, the headline unemployment rate rose 0.2 percentage points to 5.2% in May. Meanwhile, the jobless rate in manufacturing moved down one tick to 2.9%.

WAGE GROWTH IN MANUFACTURING REMAINS VERY ELEVATED

Despite the decline in employment and increase in the unemployment rate, average hourly earnings still rose by 5.1% year-over-year in May, down only a touch from 5.2% in April. This is still uncomfortably high for the Bank of Canada.

Pay gains remain considerably higher in manufacturing, consistent with a much lower unemployment rate. Indeed, even though wages in the sector posted their biggest monthly drop since July 2022, falling 0.7% in May, they were still up a whopping 8.5% from a year ago. The average hourly wage rate in manufacturing stood at $32.75 last month.

ONTARIO SEES BIGGEST LOSS IN OVERALL EMPLOYMENT BUT BIGGEST GAIN IN MANUFACTURING HEADCOUNTS

Regionally, the decrease in employment spanned 4 of 10 provinces. The largest absolute loss was recorded in Ontario (-23,900), while the largest proportional decreases were observed in Newfoundland and Labrador (-4,200) and Nova Scotia (-5,200). In more positive news, employment in Manitoba rose by 8,200 in May, its biggest monthly advance since September 2022.

In the manufacturing sector, employment was up in only 3 provinces in May. The increase was concentrated in Ontario (+20,100), with more modest gains observed in Quebec (+4,300) and Saskatchewan (+1,900). On the negative side, manufacturers in BC shed 5,800 workers in May, the second straight monthly decline. Taking a longer-term view, Alberta’s manufacturers (+14,000) have created the most jobs over the last year, while BC’s manufacturers (-11,000) have shed the most workers.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.