Labour Market Trends - February 2023; Sources: CME; Statistics Canada.

No images? Click here

Canadian Economy Adds 21,800 Jobs in February, Manufacturing Employment Up for Second Straight Month

HIGHLIGHTS

- Employment in Canada increased by 21,800 (+0.1%) in February, building on the massive upswing of 150,000 jobs in January.

- The increase in employment spanned 8 of 16 industries, with health care and social assistance, public administration, and other services recording the biggest gains.

- Manufacturing employment rose by 6,800 (+0.4%), up for the second straight month.

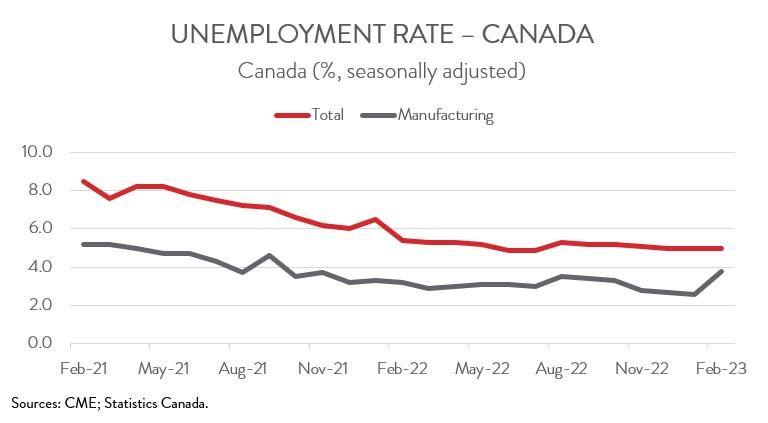

- The headline unemployment rate held steady at 5.0% in February, while the unemployment rate in manufacturing jumped 1.2 percentage points to 3.8%.

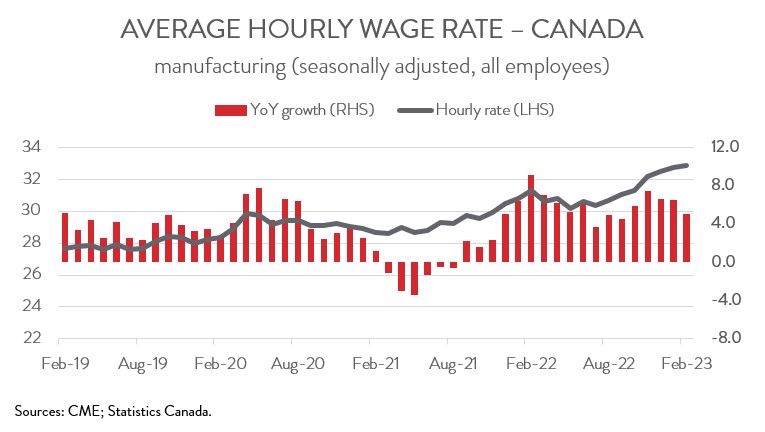

- Year-over-year wage growth in manufacturing moderated to a still-elevated 5.1% in February.

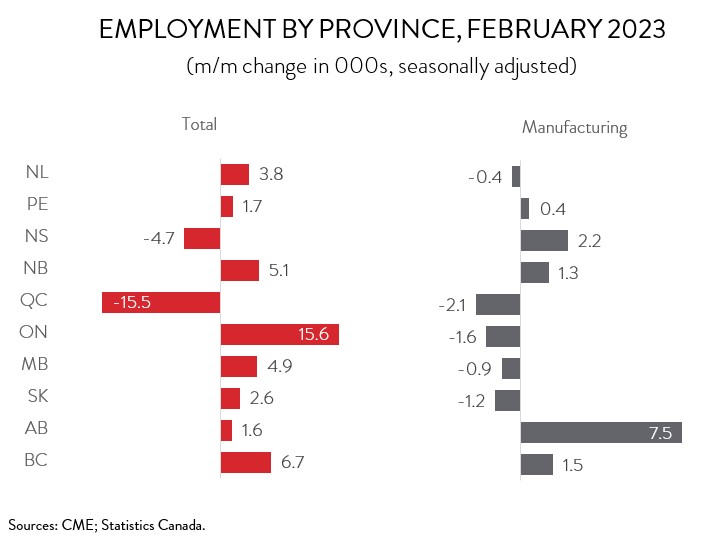

- Total employment was up in 8 of 10 provinces, with the strongest growth occurring in PEI, Newfoundland and Labrador, New Brunswick, and Manitoba.

- In manufacturing, Nova Scotia, Alberta, PEI, and New Brunswick recorded the biggest job gains.

- Canada’s labour market still has yet to show any sign of weakening in the face of substantial interest rate hikes, but it has to be only a matter of time before they begin to bite.

EMPLOYMENT INCREASES MODESTLY IN FEBRUARY

Employment in Canada increased by 21,800 (+0.1%) in February, building on the massive upswing of 150,000 jobs in January. Details of the report were solid: last month’s increase was driven by full-time work (+31,100) and by private sector employment (+38,500).

Employment was up in 8 of 16 industries. The strongest job gains were observed in health care and social assistance (+15,300), public administration (+10,000), and other services (+8,400). These increases were partially offset by pullbacks in business, building, and other support services (-10,500), finance, insurance and real estate (-8,000), and information, culture and recreation (-7,800).

Canada’s labour market still has yet to show any sign of weakening in the face of substantial interest rate hikes. However, it has to be only a matter of time before higher rates begin to take a bite out of job growth, especially with economic growth already slowing.

MANUFACTURING EMPLOYMENT UP FOR SECOND STRAIGTH MONTH

Manufacturing employment rose by 6,800 (+0.4%) in February, up for the second consecutive month and nearly matching the 7,300 new jobs created in January. However, despite these back-to back gains, the sector has created a total of only 5,100 jobs over the last 12 months, corresponding with a slowdown in real manufacturing production. On a more positive note, manufacturing employment stood at 1.799 million in February, the highest level since March 2018.

MANUFACTURING UNEMPLOYMENT RATE JUMPS

For the third consecutive month in February, the headline unemployment rate held steady at 5.0%, remaining just a hair above the record low of 4.9% reached last June and July. In contrast, the jobless rate in manufacturing jumped from an all-time low of 2.6% in January to 3.8% in February, the highest rate since September 2021.

WAGE GROWTH IN MANUFACTURING MODERATES BUT REMAINS STRONG

Average hourly wages rose 5.4% on a year-over-year basis in February, up from 4.5% in January. It should be noted, however, that the acceleration in headline wage growth was partly due to base effects, as average earnings were lower than normal in February 2022 when low-wage service workers were rehired following January’s Omicron-induced lockdowns.

While pay gains in manufacturing moderated for the third consecutive month, they remained elevated, as manufacturers continue to grapple with a shortage of workers. In fact, average hourly earnings in the manufacturing sector rose 0.3% in February, the seventh consecutive monthly advance. On a year-over-year basis, wage growth came in at 5.1% last month, down from 6.5% in January and from 7.5% in November.

EMPLOYMENT UP IN MOST PROVINCES

Regionally, the employment increase spanned 8 of 10 provinces. Job growth was strongest in PEI (+1,700), Newfoundland and Labrador (+3,800), New Brunswick (+5,100), and Manitoba (+4,900). Employment in New Brunswick has increased by 4.7% over the past 12 months, the fastest growth among the provinces.

In the manufacturing sector, employment was up in five provinces in February. The biggest proportional increases were recorded in Nova Scotia (+2,200), Alberta (+7,500), PEI (+400), and New Brunswick (+1,300). With this latest increase, manufacturers in Alberta have added workers in six of the last seven months. On the negative side, notable declines were posted in two provinces in February: Newfoundland and Labrador (-400) and Saskatchewan (-1,200).

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.