Labour Market Trends - October 2022; Sources: CME; Statistics Canada.

No images? Click here

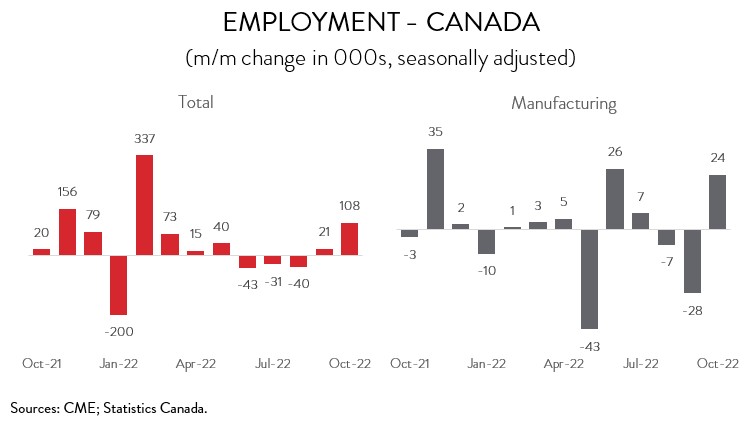

Economy Adds an Impressive 108k Jobs in October; Manufacturing Employment Up for First Time in Three Months

HIGHLIGHTS

- Employment rose by 108,300 (+0.6%) in October, recouping all the losses observed from May to September.

- The increase in employment spanned 11 of 16 industries, with construction, manufacturing, and accommodation and food services posting the biggest gains.

- Manufacturing employment rose by 23,800 (+1.4%), up for the first time in three months.

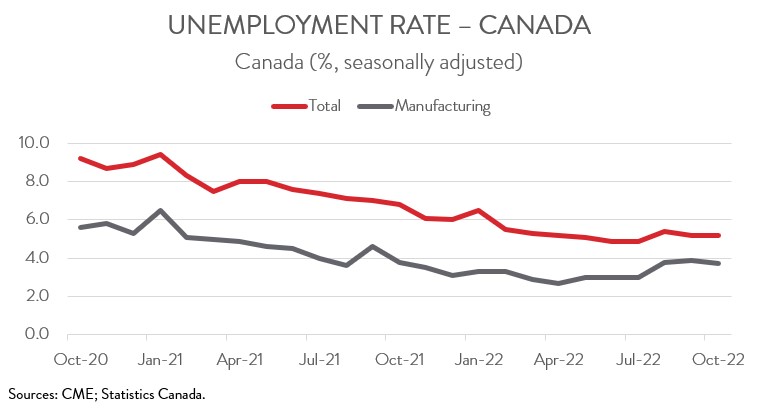

- The headline unemployment rate remained unchanged at 5.2% in October, while the unemployment rate in manufacturing decreased 0.2 percentage points to 3.7%.

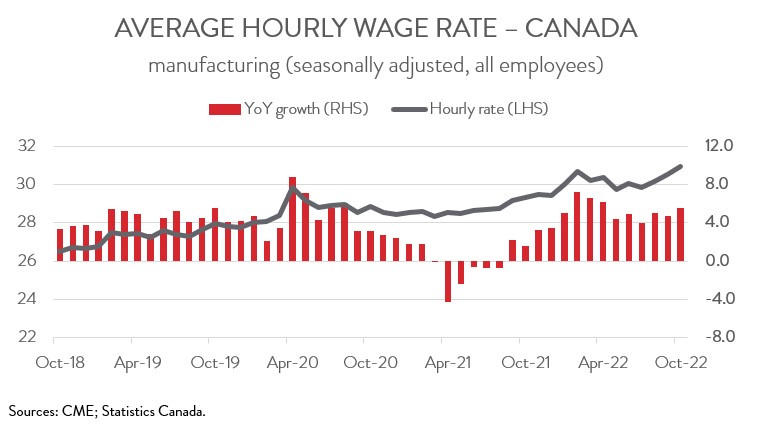

- Year-over-year wage growth in both the overall economy and manufacturing accelerated to 5.6% in October.

- Employment was up in all ten provinces, with the gains concentrated in Ontario and Quebec.

- The increase in manufacturing employment spanned 7 of 10 provinces, led by BC.

- The October jobs report blew away expectations and, as a result, raise some questions about the extent of the economic slowdown. The strong labour market data also support analysts’ expectations of a 50-basis point interest rate hike from the Bank of Canada in December.

ECONOMY SEES STRONG JOB GROWTH IN OCTOBER

Employment rose by 108,300 (+0.6%) in October, recouping all the losses observed from May to September. The strong job growth lifted employment to an all-time high of 19.656 million.

By industry, the job increases spanned 11 of 16 industries. The strongest gains were observed in construction (+24,600), manufacturing (+23,800), and accommodation and food services (+18,300). Wholesale and retail trade (-20,200) was the only industry to report a notable decline.

The October jobs report blew away expectations. The rebound in employment, the surge in hours worked, and the acceleration in wage growth all raise some questions about the extent of the economic slowdown. The strong labour market data also support analysts’ expectations of a 50-basis point interest rate hike from the Bank of Canada in December.

MANUFACTURERS ADD WORKERS FOR FIRST TIME IN THREE MONTHS

As mentioned above, manufacturing employment rose by 23,800 (+1.4%) in October, the first increase in three months and largely offsetting the decrease of 27,500 (-1.6%) in September. Still, even with this gain, the manufacturing sector has shed 21,700 workers since the beginning of the year. As of October, employment in the sector stood at 1.744 million.

UNEMPLOYMENT RATE HOLDS STEADY

The headline unemployment rate held steady at 5.2% in October, 0.3 percentage points above the record low observed in June and July. At the same time, the jobless rate in manufacturing decreased for the first time in six months, falling 0.2 percentage points to 3.7%.

WAGE GROWTH ACCELERATES

The combination of strong job gains and an exceptionally large number of job vacancies boosted average hourly earnings in the overall economy by 0.9% in October, the third consecutive monthly advance. This pushed up year-over-year wage growth to 5.6%. Excluding the unusually strong wage growth observed during the first year of the pandemic in 2020, this was the second strongest gain on record.

A similar story continues to unfold in manufacturing. Average hourly earnings rose 1.3% in October, the biggest one-month gain since January 2022. Accordingly, year-over-year wage growth accelerated to 5.6%, more than double the sector’s historical average of 2.5%. The strong wage growth is consistent with the results of CME’s recently released 2022 Labour and Skills Survey, which shows that manufacturers continue to face severe labour shortages.

EMPLOYMENT INCREASE WIDESPREAD ACROSS THE COUNTRY

Regionally, the employment increase spanned all ten provinces. The largest absolute gains were recorded in Ontario (+42,700) and Quebec (+27,800), while the largest proportional increase was observed in PEI (+4,300). The gains in Ontario were largely in part-time work and were concentrated in accommodation and food services and professional, scientific and technical services. In tandem with the strong job growth, Quebec’s unemployment rate also fell 0.3 percentage points to 4.1%, the lowest in the country.

In the manufacturing sector, employment was up in seven provinces in October. The bulk of the gains were posted in BC (+11,500) and Nova Scotia (+3,700). This was BC’s first increase in manufacturing employment since June 2022. Newfoundland and Labrador (-1,500) and New Brunswick (-1,400) were the only provinces to post notable declines.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters.

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.