Labour Market Trends - January 2023; Sources: CME; Statistics Canada.

No images? Click here

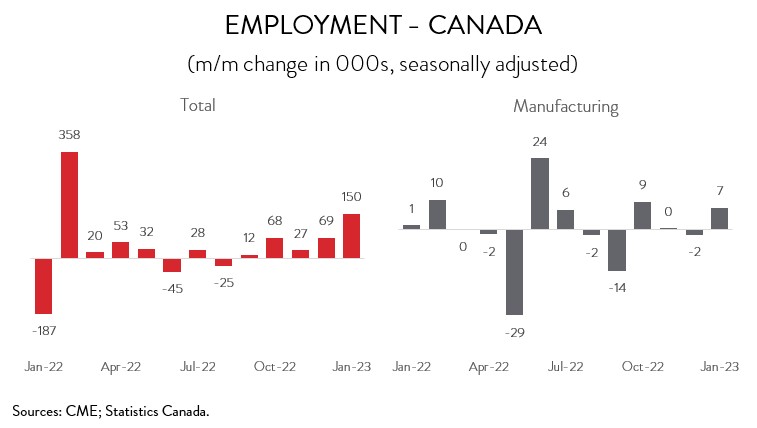

Canadian Economy Smashes Expectations with 150,000 New Jobs in January; Manufacturing Employment Also Increases

HIGHLIGHTS

- Canadian employment surged by 150,000 (+0.8%) in January, the fifth consecutive monthly advance.

- The increase in employment spanned 10 of 16 industries, with wholesale and retail trade, health care and social assistance, and educational services recording the biggest gains.

- Manufacturing employment rose by 7,300 (+0.4%), the strongest gain in three months.

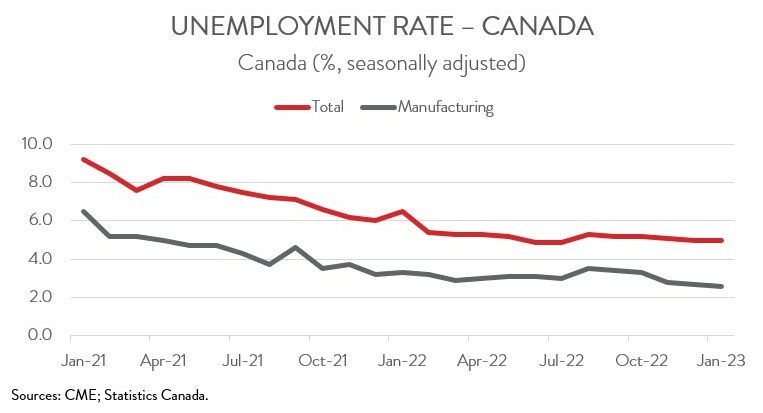

- The headline unemployment rate held steady at 5.0% in January, while the unemployment rate in manufacturing dropped 0.1 percentage points to a record low of 2.6%.

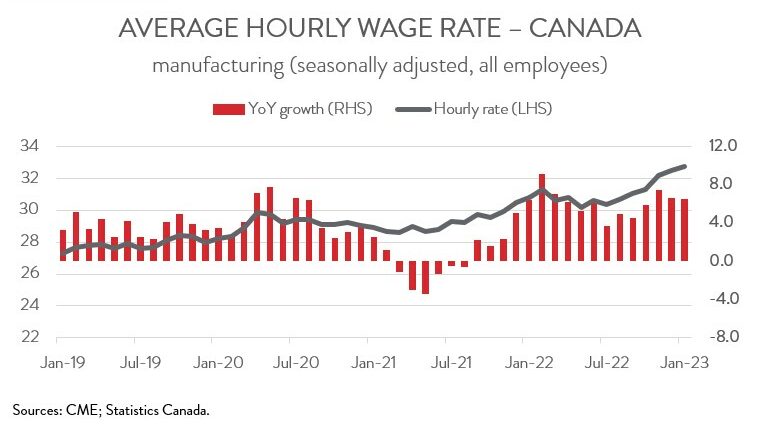

- Year-over-year wage growth in manufacturing moderated to a still-brisk pace of 6.5% in January.

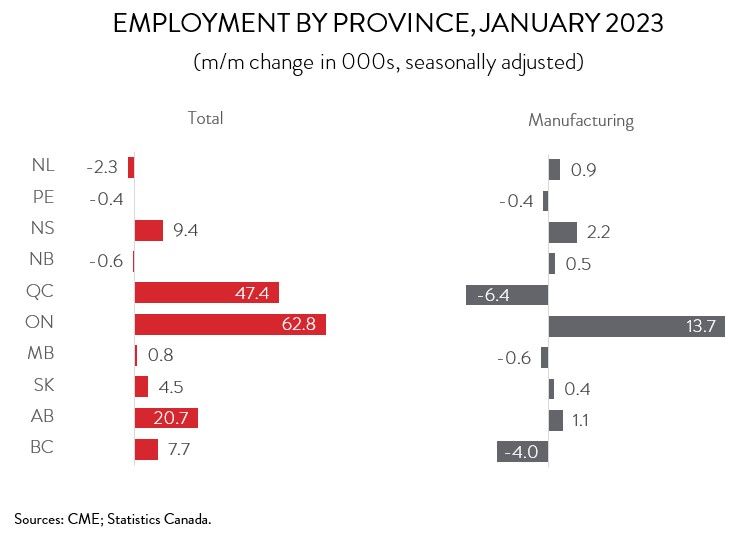

- Total employment was up in 7 of 10 provinces, with the largest increases occurring in Ontario, Quebec, and Alberta.

- The increase in manufacturing employment was concentrated in Ontario.

- The surge in hiring in January suggests that the Canadian economy is not heading into an imminent recession, defying many economists’ predictions.

EMPLOYMENT SOARS IN JANUARY

Canadian employment surged by 150,000 (+0.8%) in January, the fifth consecutive monthly increase. In more good news, last month’s increase was driven by full-time work (+121,000) and by private sector employment (+115,000).

Employment was up in 10 of 16 industries. The biggest increases were observed in wholesale and retail trade (+58,700), health care and social assistance (+40,000), and educational services (+18,400). Partly offsetting these gains was a decrease of 16,600 jobs in transportation and warehousing, the sector’s first notable decline since March 2022.

The surge in hiring in January suggests that the Canadian economy is not heading into an imminent recession, defying many economists’ predictions. While one data release will not convince the Bank of Canada to reconsider its “conditional” pause to further interest rate hikes, it is important to note that one of the conditions of this pause is that the job market cools off.

MANUFACTURING EMPLOYMENT INCREASES IN JANUARY

Manufacturing employment rose by 7,300 (+0.4%) in January, the strongest gain in three months. However, despite this increase, the sector has created a total of only 8,300 jobs over the last 12 months, coinciding with recent softness in other key indicators like GDP, exports, and manufacturing sales. As of January, manufacturing employment stood at 1.792 million.

MANUFACTURING UNEMPLOYMENT RATE HITS RECORD LOW

The headline unemployment rate held steady at 5.0% in January, remaining just a hair above the record low of 4.9% reached last June and July. In contrast, the jobless rate in manufacturing hit an all-time low, falling 0.1 percentage points to 2.6% last month.

WAGES IN MANUFACTURING CONTINUE TO GROW AT BRISK PACE

Average hourly wages rose 4.5% on a year-over-year basis in January, down from 4.8% in December and from a recent peak of 5.8% in November. While this would normally be considered good news for those worried about wages feeding into inflation, last month’s deceleration largely reflected the fact that average earnings were higher than normal in December 2021 as Omicron-driven shutdowns led to temporary job losses in low wage sectors.

While pay gains in manufacturing also slowed for the second consecutive month, they continued to grow at a brisk pace, indicating that manufacturers continue to face significant challenges finding workers. In fact, average hourly earnings in the manufacturing sector rose 0.9% in January, the sixth straight monthly advance. On a year-over-year basis, wage growth came in at 6.5% in January, down from 6.6% in December and from 7.5% in November.

EMPLOYMENT UP IN SEVEN PROVINCES

Regionally, the employment increase spanned 7 of 10 provinces. The largest absolute gains were recorded in Ontario (+62,800), Quebec (+47,400), and Alberta (+20,700), while the largest proportional increase was observed in Nova Scotia (+9,400). This was Nova Scotia’s second notable gain in three months. In Alberta, employment has climbed by 99,000 over the last year, nearly all in full-time work.

In the manufacturing sector, employment was up in six provinces in January. The lion’s share of the increase was registered in Ontario (+13,700), fully recouping losses sustained in the previous two months. Noteworthy gains were also observed in Nova Scotia (+2,200) and Newfoundland and Labrador (+900), while notable declines were recorded in Quebec (-6,400) and BC (-4,000). In the last 12 months, BC’s manufacturing sector has lost 22,000 jobs.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.