January 2023 - All data sourced from CME; Statistics Canada.

No images? Click here

Canadian Trade Surplus Widens in January, as Exports Post Strong Growth

HIGHLIGHTS

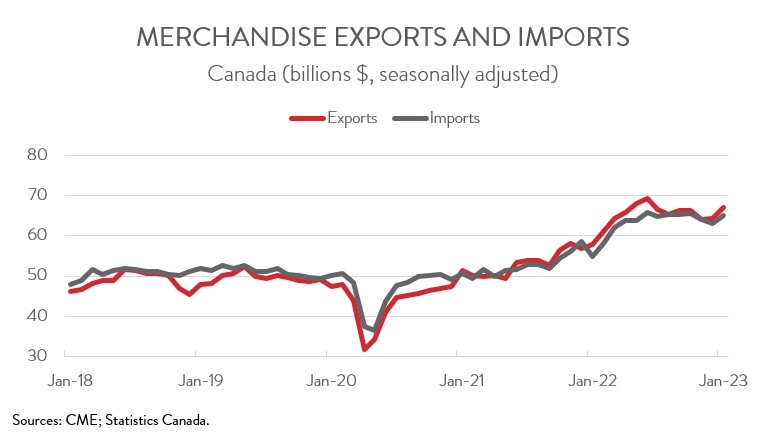

- Canadian merchandise exports rose 4.2% to $67.0 billion in January, while merchandise imports increased 3.1% to $65.1 billion.

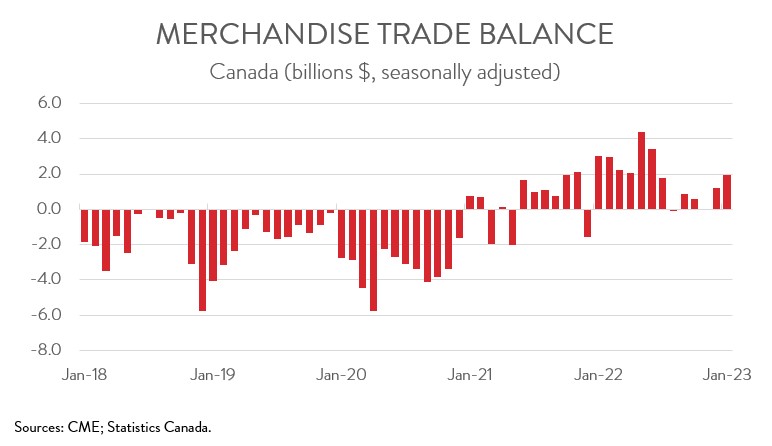

- Canada’s merchandise trade surplus widened from $1.2 billion in December to $1.9 billion in January.

- After removing price effects, export volumes and import volumes were up 5.3% and 4.1%, respectively.

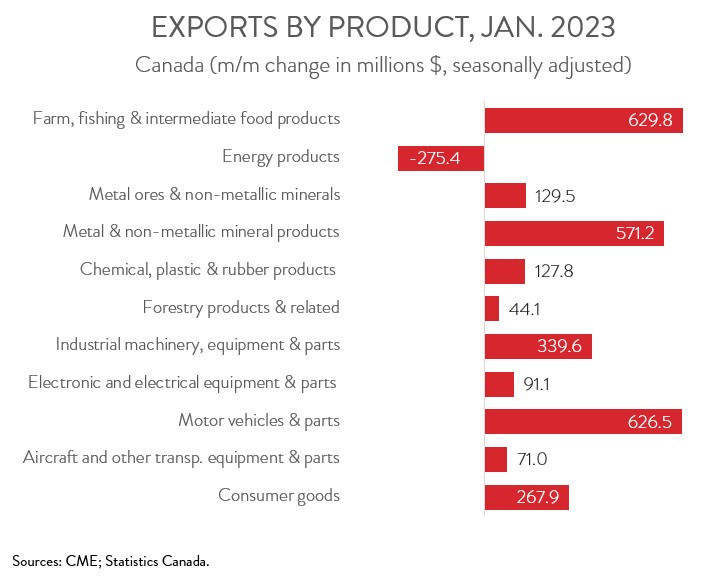

- The export gains were widespread, with all product sections increasing except energy products.

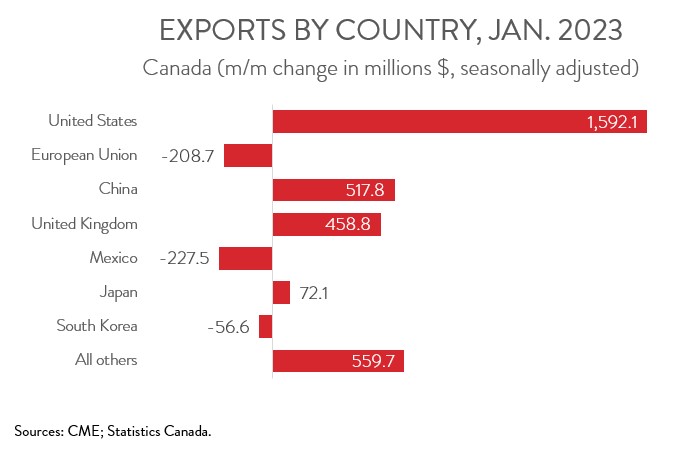

- Exports to the U.S. climbed 3.3% to $50.3 billion in January, while exports to the rest of the world increased 7.2% to $16.7 billion.

- The upside surprise in today’s trade report is another sign that Canada’s economy is performing better than expected to start 2023. In particular, export activity continues to be bolstered by solid global demand for Canadian commodities and by a recovery in auto production. But with global economic growth slowing due to rapid central-bank policy tightening, it is difficult to see the momentum continuing in the coming months.

EXPORTS AND IMPORTS BOTH SEE STRONG GAINS IN JANUARY

Canadian merchandise exports rose 4.2% to $67.0 billion in January, while merchandise imports increased 3.1% to $65.1 billion. In real or volume terms, the picture was even more upbeat, with exports and imports up 5.3% and 4.1%, respectively.

The upside surprise in today’s trade report is another sign that Canada’s economy is performing better than expected to start 2023. In particular, export activity continues to be bolstered by solid global demand for Canadian commodities and by a recovery in auto production. But with global economic growth slowing due to rapid central-bank policy tightening, it is difficult to see the momentum continuing in the coming months.

CANADA’S TRADE SUPRLUS WIDENS

Canada’s merchandise trade surplus widened from $1.2 billion in December to $1.9 billion in January, the eleventh surplus in the past thirteen months. Breaking the numbers down, our trade surplus with the U.S. widened from $8.4 billion in December to $9.0 billion in January. At the same time, Canada’s trade deficit with the rest of the world narrowed slightly from $7.2 billion to $7.1 billion.

EXPORT GAINS WIDESPREAD ACROSS PRODUCT SECTIONS

The export gains were widespread, with all product sections increasing except energy products. Indeed, non-energy exports rose 6.1% to a record $51.6 billion in January.

Farm, fishing and intermediate food products contributed the most to the growth, with exports increasing 11.9% to an all-time high of $5.9 billion in January. Notably, exports of farm products ramped up in the fall and have been elevated ever since, thanks to a bumper harvest and strong global demand.

Exports of motor vehicles and parts climbed 8.2% to $8.3 billion in January, the highest level since May 2019. Exports of passenger cars and light trucks drove the gain, corresponding with an increase in production at many Canadian assembly plants. This is further evidence that the shortage of semiconductors and other supply chain challenges that have plagued the industry for months are continuing to subside.

Following a 6.7% decline in December, exports of metal and non-metallic mineral products rose 8.3% to $7.5 billion in January. Exports of unwrought gold, silver, and platinum group metals, and their alloys—a category dominated by unwrought gold—contributed the most to the monthly gain.

On the negative side, exports of energy products fell 1.8% to $15.5 billion in January, the third decline in four months. The decrease in January was fuelled by lower exports of natural gas, largely owing to a drop in prices. As noted by Statistics Canada, natural gas prices fell sharply in January after peaking in December 2022, when severe winter weather in the U.S. caused a spike in demand and disrupted production.

EXPORTS TO THE U.S. UP FOR SECOND MONTH IN A ROW

Exports to the U.S. increased 3.3% to $50.3 billion in January, up for the second month in a row. At the same time, exports to the rest of the world jumped 7.2% to a record $16.7 billion. Among Canada’s major non-U.S. trading partners, exports to China, the U.K, and Japan were up, while exports to Mexico, the EU, and South Korea were down. The increase in exports to China was fueled by canola oil and coal, while the increase in exports to the U.K. was driven by refined gold.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters.

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.