Labour Market Trends - April 2023; Sources: CME; Statistics Canada.

No images? Click here

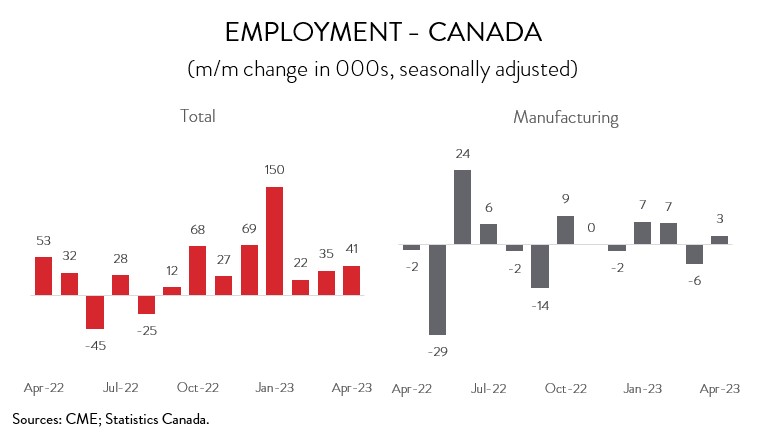

Canada Posts Eighth Straight Monthly Job Gain in April; Manufacturing Employment Also Rises

HIGHLIGHTS

- Employment in Canada rose by 41,400 (+0.2%) in April, the eighth straight monthly increase.

- Employment was up in 9 of 16 industries, led by wholesale and retail trade, transportation and warehousing, information and cultural industries, and educational services.

- Manufacturing employment climbed by 2,800 (+0.2%) in April, up for the third time in four months.

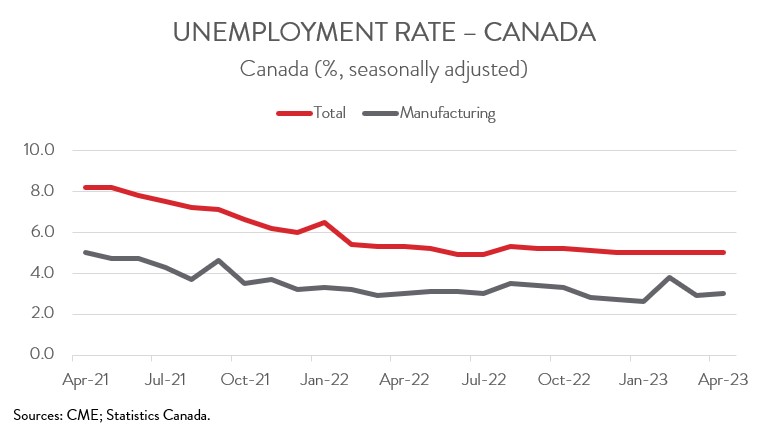

- The headline unemployment rate held steady at 5.0% for the fifth consecutive month, while the jobless rate in manufacturing inched up from 2.9% in March to 3.0% in April.

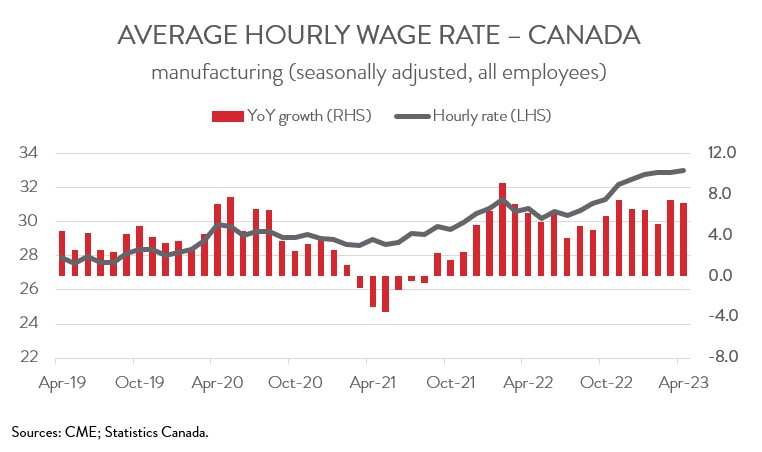

- Wages in the manufacturing sector were up a very elevated 7.2% year-over-year in April, down modestly from a 7.4% increase in March.

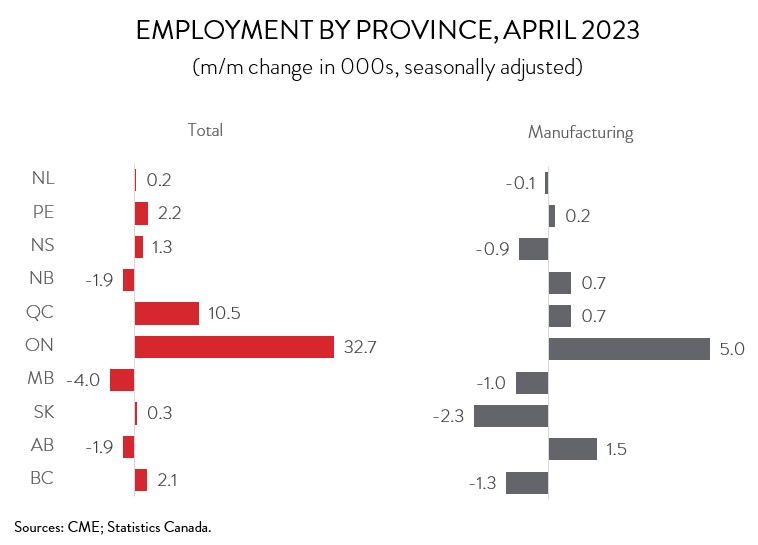

- Total employment was up in 7 of 10 provinces, led by Ontario and PEI. Ontario was also responsible for the bulk of the job gains in manufacturing.

- The manufacturing sector has created only 3,700 jobs over the last 12 months. The tepid pace of job growth is consistent with a sector that is being held back by slower demand for consumer goods amid sharply higher interest rates and the ongoing post-COVID shift to spending on services.

EMPLOYMENT CONTINUES TO CLIMB HIGHER IN APRIL

Employment in Canada rose by 41,400 (+0.2%) in April, the eighth straight monthly advance. However, the underlying details of the report were not as strong as the headline number, as all of the increase came in part-time work (+48,000).

Employment was up in 9 of 16 industries in April, led by wholesale and retail trade (+24,400), transportation and warehousing (+16,500), information and cultural industries (+16,100), and educational services (+14,500). Notably, employment in transportation and warehousing, one of the harder-hit sectors during the pandemic, finally returned to its February 2020 level. Increases in those four sectors were partially offset by pullbacks in business, building and other support services (-14,000) and finance, insurance and real estate (-8,800).

MANUFACTURING EMPLOYMENT CLIMBS

Manufacturing employment climbed by 2,800 (+0.2%) in April, up for the third time in four months. Despite the recent employment gains, the sector has created only 3,700 jobs over the last 12 months. This tepid pace of job growth is consistent with a sector that is being held back by slower demand for consumer goods amid sharply higher interest rates and the ongoing post-COVID swing from spending on goods to spending on services.

MANUFACTURING UNEMPLOYMENT RATE INCHES UP

For the fifth consecutive month in April, the headline unemployment rate held steady at 5.0%, remaining just a hair above the record low of 4.9% reached last June and July. Meanwhile, the jobless rate in manufacturing inched up from 2.9% in March to 3.0% in April, only 0.4 percentage points above the all-time low.

WAGE GROWTH IN MANUFACTURING REMAINS ELEVATED

Tight labour market conditions continue to put upward pressure on wages. Average hourly earnings rose 5.2% on a year-over-year basis in April, down only a touch from 5.3% in March.

Pay gains remain considerably higher in manufacturing, consistent with a much lower unemployment rate. Indeed, wages in the sector were up a very elevated 7.2% year-over-year in April, a modest slowdown from the 7.4% increase seen in March. The average hourly wage rate in manufacturing came in just shy of $33 last month.

SEVEN PROVINCES RECORD JOB GAINS

Regionally, the employment increase spanned 7 of 10 provinces. The largest absolute gain was recorded in Ontario (+32,700), while the largest proportional increase was observed in PEI (+2,200), the island province’s fourth increase in the past five months. On the downside, employment in Manitoba fell by 4,400 in April, following solid gains in the previous two months.

In the manufacturing sector, employment was up in five provinces in April. Ontario (+5,000) was responsible for the bulk of the increase in hiring, with other notable gains reported in PEI (+200), New Brunswick (700), and Alberta (1,500). Gains in those provinces were partially offset by a loss of 2,300 manufacturing jobs in Saskatchewan, the biggest monthly drop since April 2022. Taking a longer-term view, Alberta’s manufacturers (+15,600) have created the most jobs over the last year, while BC’s manufacturers (-18,000) have shed the most workers.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.