April 2023 - All data sourced from CME; Statistics Canada.

No images? Click here

Merchandise Exports Jump in April, With Volumes Hitting Record High

HIGHLIGHTS

- Canada’s merchandise exports increased 2.5% to $64.8 billion in April, while imports edged down 0.2% to $62.9 billion.

- As a result, the country’s trade surplus with the world widened from $231 million in March to $1.94 billion in April.

- Export volumes jumped 2.8%, hitting an all-time high and finally surpassing their pre-COVID levels.

- The increase in nominal exports spanned 6 of 11 product sections, and was driven by exports of gold, crude oil, and passenger cars and light trucks.

- Exports to the U.S. rose 4.4% to $49.6 billion in April, while exports to the rest of the world contracted 3.1% to $15.3 billion.

- With Canada’s trade surplus widening in April, net trade is on track to contribute positively to second quarter GDP growth. That said, the global economy remains on shaky ground amid high interest rates and, as such, world trade growth is expected to remain subdued over the near term.

EXPORTS UP 2.5% IN APRIL

Canada’s merchandise exports increased 2.5% to $64.8 billion in April, while imports edged down 0.2% to $62.9 billion. The picture was even more upbeat in volume terms, with real exports and real imports up 2.8% and 0.9%, respectively. As a result, export volumes reached an all-time high and finally surpassed their pre-COVID levels.

With Canada’s trade surplus widening in April, net trade is on track to contribute positively to second quarter GDP growth. That said, the global economy remains on shaky ground amid high interest rates and, as such, world trade growth is expected to remain subdued over the near term.

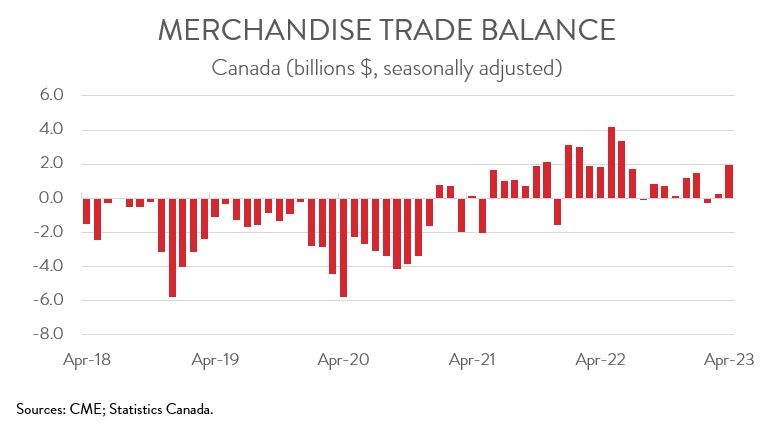

CANADA RECORDS LARGEST TRADE SURPLUS SINCE JUNE 2022

The country’s trade surplus widened from a downwardly revised $231 million in March to $1.94 billion in April, the largest surplus since June 2022. Breaking the numbers down, Canada’s trade surplus with the U.S. widened from $7.2 billion in March to $9.5 billion in April, while our trade deficit with the rest of the world widened from $7.0 billion to $7.5 billion.

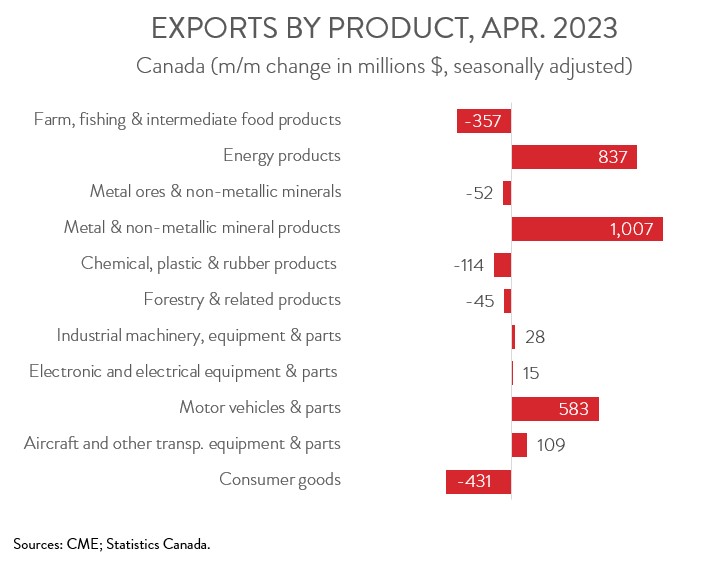

INCREASE IN EXPORTS LED BY METAL AND NON-METALLIC MINERAL PRODUCTS

The increase in exports spanned 6 of 11 product sections. Exports of metal and non-metallic mineral products rose the most, climbing 13.6% to a record high of $8.4 billion in April. As highlighted by Statistics Canada, the gain largely reflected higher transfers of gold assets from Canadian financial institutions to the U.S.

Elsewhere, exports of energy products climbed 6.4% to $13.9 billion in April. Crude oil exports posted their first gain in seven months, as crude oil export prices increased for just the second time since May 2022. Coal exports also contributed positively to the section’s growth.

Exports of motor vehicles and parts rose 7.4% to $8.5 billion in April, yet another sign that supply chain disruptions continue to ease. The gain was driven by both exports of passenger cars and light trucks and exports of engines and parts.

Gains in those product sections were sufficient to overcome notable declines in exports of consumer goods (-5.5%) and farm, fishing and intermediate products (-6.4%). Although this was the second straight monthly decline for exports of farm, fishing and intermediate products, they were still up 32.5% year-over-year.

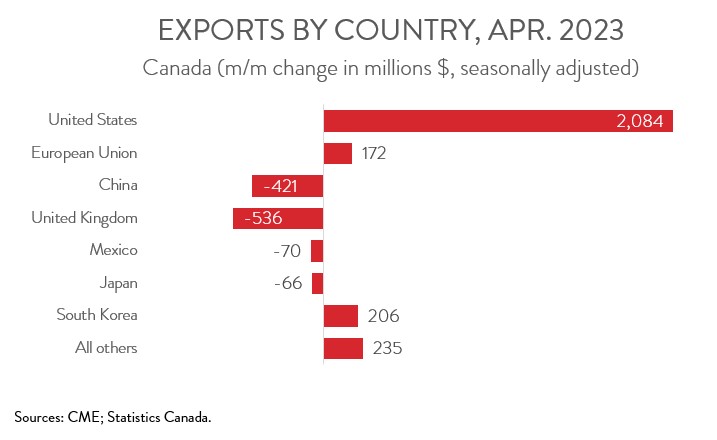

EXPORTS TO THE U.S. UP FOR FIRST TIME IN THREE MONTHS

Exports to the U.S. increased 4.4% to $49.6 billion in April, up for the first time in three months. The increase was mainly attributable to higher exports of gold.

In contrast, exports to the rest of the world decreased 3.1% to $15.3 billion in April. Among Canada’s major non-U.S. trading partners, exports to the U.K, China, Mexico, and Japan were down, while exports to South Korea and the EU were up. The decrease in exports to the U.K. was driven by gold, while the increase in exports to South Korea was fueled by coal.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters.

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.