Labour Market Trends - June 2023; Sources: CME; Statistics Canada.

No images? Click here

Canada Adds 60,000 Jobs in June; Manufacturing Employment Reaches Highest Level Since 2008

HIGHLIGHTS

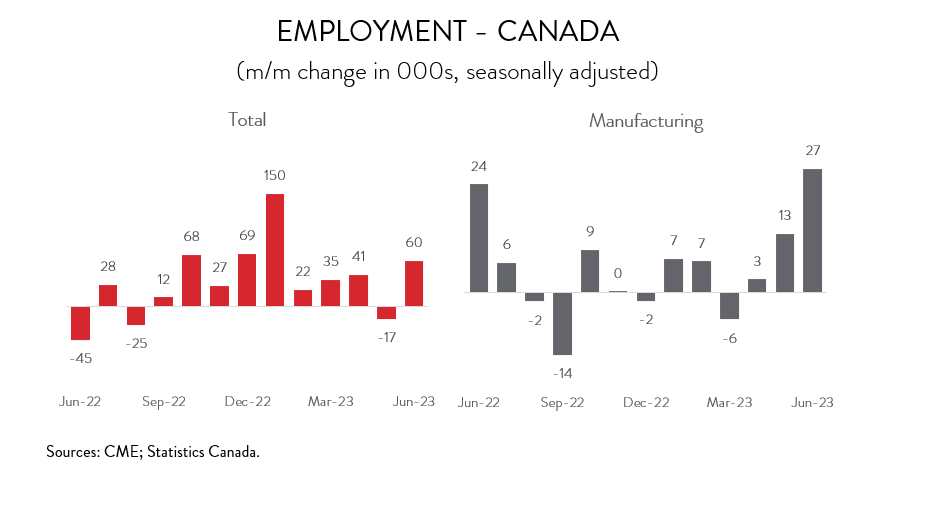

- Employment in Canada rose by 60,000 (+0.3%) in June, the strongest gain in five months.

- The increase spanned 7 of 16 industries and was led by wholesale and retail trade, manufacturing, and health care and social assistance.

- Manufacturing employment increased by 27,300 (+1.5%) to 1.836 million in June, the biggest monthly gain since September 2020 and the highest level since December 2008.

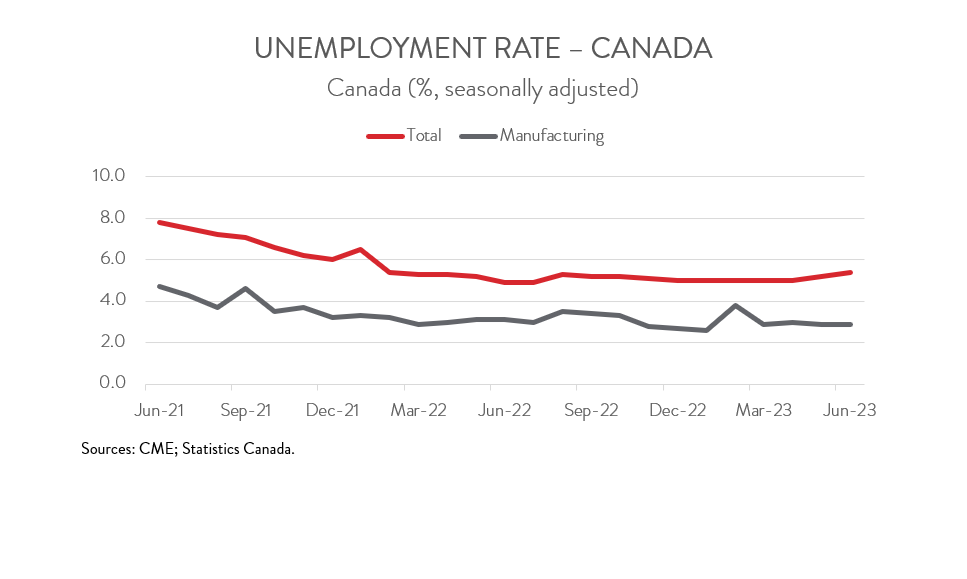

- The headline unemployment rate rose 0.2 percentage points to 5.4% in June, while the jobless rate in manufacturing remained unchanged at 2.9%.

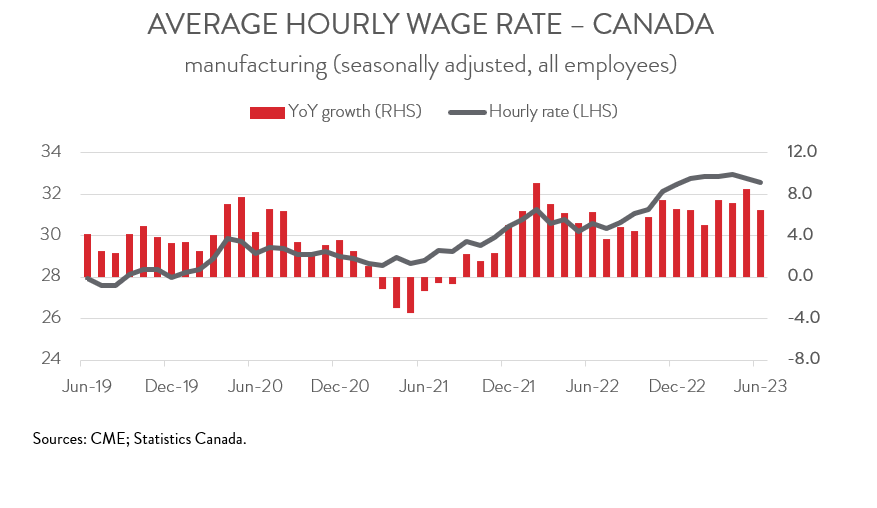

- While wages in the manufacturing sector fell for the second consecutive month in June, the year-over-year increase still came in at an elevated 6.5%.

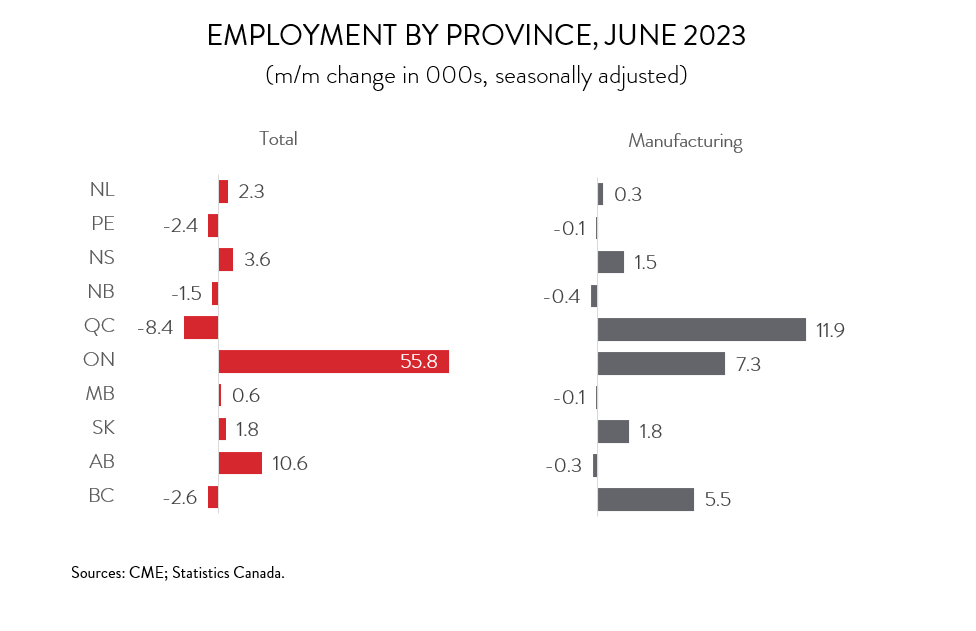

- Total employment was up in 6 of 10 provinces, led by Ontario, Nova Scotia, and Newfoundland and Labrador. Quebec posted the biggest increase in manufacturing employment.

- While the Bank of Canada will take comfort in a rising unemployment rate and slowing wage growth, the strong job gains observed in June will likely tip the balance in favour of another interest rate hike on July 12th.

CANADA’S JOB MARKET STAYS RESILIENT

Employment in Canada rose by 60,000 (+0.3%) in June, the strongest gain in five months. The underlying details of the report were mostly solid, as last month’s gains were driven by full-time work (+109,600) and private sector employment (+82,500).

The increase spanned 7 of 16 industries and was led by wholesale and retail trade (32,600), manufacturing (+27,300), and health care and social assistance (+20,700). These increases were partially offset by pullbacks in educational services (-14,000) and construction (-13,500).

While the Bank of Canada will take comfort in a rising unemployment rate and slowing wage growth, the strong job gains observed in June will likely tip the balance in favour of another interest rate hike on July 12th.

MANUFACTURING EMPLOYMENT REACHES HIGHEST LEVEL SINCE 2008

As mentioned above, manufacturing employment climbed by 27,300 (+1.5%) in June, the biggest monthly gain since September 2020. Accordingly, employment in the sector stood at 1.836 million last month, the highest level since December 2008.

Manufacturers have now added jobs for three consecutive months, a somewhat surprising turn of events given the challenging economic backdrop. Indeed, despite the recent strong run, the manufacturing sector still faces several headwinds that should limit job creation over the near term, including ongoing labour and skills shortages and soft global demand. It is also worth noting that manufacturing employment remains about half a million below its November 2002 peak.

MANUFACTURING UNEMPLOYMENT RATE REMAINS STABLE

The headline unemployment rate rose 0.2 percentage points to 5.4% in June, following an identical increase in May. This brought the rate to its highest level since February 2022 when it was also 5.4%. Meanwhile, the jobless rate in manufacturing remained unchanged at 2.9%, just 0.3 percentage points above its record low.

WAGE GROWTH IN MANUFACTURING SLOWS BUT REMAINS ELEVATED

The rise in the headline unemployment rate is easing pressure on wages. Average hourly earnings were up 4.2% year-over-year in June, down from 5.1% in May and the slowest gain in 13 months. Still, this is well above the historical average of 2.9%.

As has been the case for most months since late 2021, pay gains were considerably higher in manufacturing, consistent with relatively tighter labour market conditions. While wages in the sector fell for the second consecutive month in June, the year-over-year increase still came in at an elevated 6.5%.

JOB GAINS SEEN IN SIX PROVINCES, LED BY ONTARIO

Regionally, the increase in employment spanned 6 of 10 provinces. The biggest absolute gain was recorded in Ontario (+55,800), while the largest proportional increases were observed in Nova Scotia (+3,600) and Newfoundland and Labrador (+2,300). Employment in Ontario has been on an upward trend for several months, with overall gains totalling 236,400 since September 2022.

In the manufacturing sector, employment was also up in six provinces in June. The largest absolute increase was seen in Quebec (+11,900), while the biggest proportional gain was posted in Saskatchewan (+1,800). Taking a longer-term view, Ontario’s manufacturers (+35,000) have created the most jobs over the last year, while BC’s manufacturers (-15,000) have shed the most workers.

ABOUT OUR CHIEF ECONOMIST

Alan Arcand

Chief Economist,

Canadian Manufacturers & Exporters

Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public.

Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.