|

The collapse of Silicon Valley Bank earlier this month sparked the nation’s first banking crisis since the Great Recession. Most of the drama felt rather contemporary: Its customers were concentrated in the tech sector and startups, and they rushed to withdraw their money online instead of standing in lines.

But, in an article explaining how banking crises have unfolded for the past century, University of Southern California finance professor Rodney Ramcharan makes clear how much today’s banking problems have in common with what occurred not just in the Great Recession but many times before that. His short history of bank runs is a reminder of how regulations can buttress the country’s financial health – and the dangers of rolling them back.

Also today:

Also, this week is our spring campaign. Please consider donating to allow our nonprofit newsroom to continue bringing you the information you value.

|

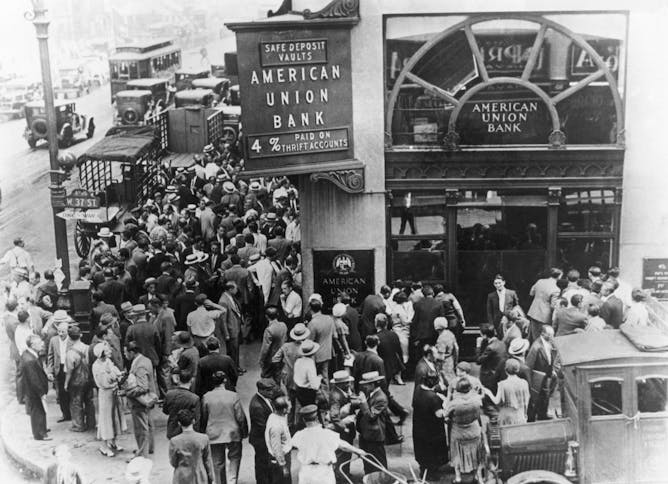

Thousands of banks failed in the Great Depression.

Bettmann via Getty Images

Rodney Ramcharan, University of Southern California

Crises fueled by bank runs, starting with the Great Depression, have had something in common: Unexpected changes spur bank failures, followed by general panic and then large-scale economic distress.

|

Arts + Culture

|

-

Alva Noë, University of California, Berkeley

In between pitches, it might seem as if nothing is going on. But the game’s drama is still unfurling – you just need to know what to look for.

|

|

Ethics + Religion

|

-

Lloyd Daniel Barba, Amherst College

A scholar of religion looks at how faith helped guide the labor rights icon in his organizing endeavors.

|

|

Politics + Society

|

-

Zanele Nyoni- Wood, Lancaster University

It seems likely that Uganda’s president, who has described homosexuality as ‘disgusting’ will pass this bill into law.

|

|

Science + Technology

|

-

Suzana Herculano-Houzel, Vanderbilt University

Neuroscientists have typically thought of energy supply to the brain as demand-based. A supply-limited view offers another perspective toward aging and why multitasking can be difficult.

|

|

Education

|

-

Philip J. Lazarus, Florida International University

Students may need a listening ear and reassurance in the aftermath of having witnessed a school shooting.

|

|