Invest smarter — Weekly news and analysis to help real estate entrepreneurs be better.

No images? Click here

💼 The Bank of Regulation

briefcase | invest smarter | issue #88

📚 BRIEFCASE'S BOOKSHELF

A big shout out to Swiftlane's Multifamily Edge weekly newsletter for first bringing this week's topic to our attention. If you aren't subscribed, you should be!

🤑 Regulation Inflation

"We need more housing!" — Every Politician

"I can't afford to buy a house!" — Every Millennial

"I have 6 weeks of vacation and still don't know how to navigate an airport!" — Boomers

"You're a developer? Evil!" — NIMBYs

*Fist bumps developer* — YIMBYs

Housing debates come down to two fundamental issues: supply and affordability. No matter what side you are on, we can all agree on one thing:

Everyone should have access to a safe and affordable roof over their heads.

Now, how we achieve that lofty goal is another matter entirely. Some demonize developers as greedy capitalists who only care about profits, others see them as the most important component to solving affordable housing.

We tend to agree with the latter. You can't solve housing without the private sector. And, there is one major blocker to the private sector building more housing...

According to a new study by the National Multifamily Housing Council (NMHC) and the National Association of Home Builders (NAHB), overly burdensome and costly regulations are at the heart of our supply woes.

Here are the highlights...

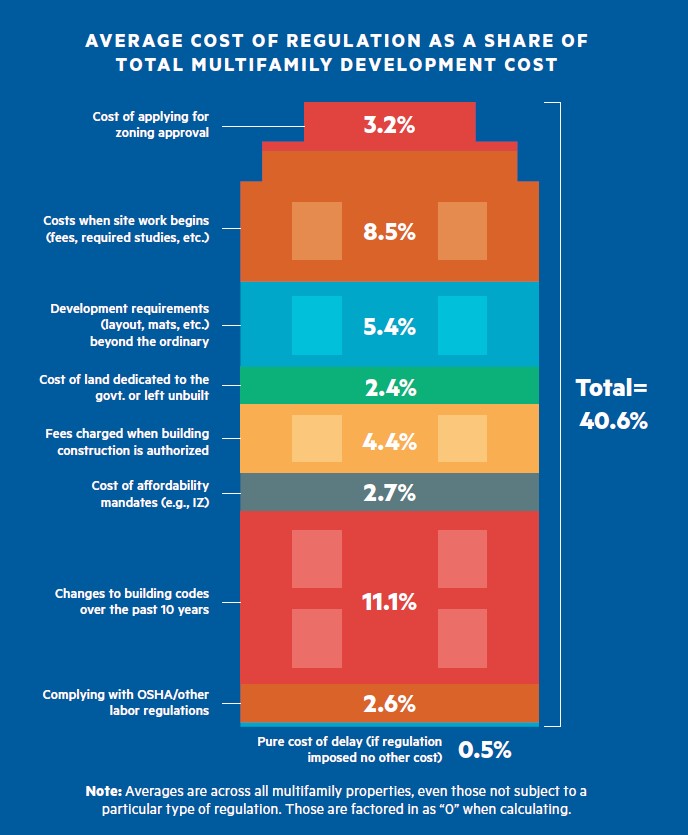

- 🤯 Added together, all forms of regulation account for an astounding 40.6% of total multifamily development costs.

- 🤯 74% of developer respondents said they encountered NIMBY opposition, which adds an average of 5.6% to total development costs and delays the completion by an average of 7.4 months.

- 🤯 87.5% avoid working in markets with rent control. This means housing is not being built in areas where it is needed the most.

- 🤯 94% of the respondents indicate that they must dedicate resources (aka $) to rezoning.

Particularly troubling is the barrage of municipal fees paid for by developers. According to the study, examples of municipal fees include impact fees, permit fees, and utility fees. 98% of respondents to the survey reported paying these fees, representing an average of 8.7% of total development costs.

Keep in mind that a developer is more than likely using an underutilized plot of land — vacant or dilapidated — which the city wasn't gaining much, or any, taxes on.

Once a new building is there, the tax revenue to the city will be significantly more. Why is the city making so much money prior to even putting shovels in the ground? A thought experiment...

🏗️ A low-rise 5-unit building costs about $1M to build.

💸 Add 40% for your municipal fees and regulatory costs, and that price jumps to 1.4M.

🤷🏻♀️ A building, roughly valued at $1.4M, will pay at the low end, $21,000 per year in municipal taxes alone.

Question: Is it fair to demand this developer, who is part of the solution to low housing supply, to pay $400,000 upfront, plus an additional $21,000 per year to build and operate a small apartment?

There is almost a triple tax levied on developers with all the upfront soft costs, permit fees, and then ongoing taxes.

Let's be clear, we are not advocating developers pay nothing, as serious infrastructure and municipal input are needed at various levels of construction. But, given our housing shortage, could we benefit from a different cost structure for developers to incentivize more construction?

We think yes. How else is America going to get to the 5 million homes currently needed to bring equilibrium back to the supply and demand of housing?

The Alligator Ate My Regulations

Florida, the land of "man killed by an alligator while hiding from cops," is also the state with a new deregulation project aimed to address the expensive bureaucratic black hole of housing permits.

Last year, not only did Governor Ron DeSantis get a permanent spray tan to prepare for the 2024 Presidential Election, but also signed into law a bill that changes Florida's permitting process.

The new law requires towns to post permits online as well as their statuses. Further, it requires the city or county to approve or request corrections to a permit within 30 days. If they don't, they will need to refund 10% of the application fee.

The average single-family home construction delay in Florida, according to one study, adds 5.9% to the sale cost. That's a significant amount...

Source: James Madison Institute

In many cases, the permit fee is a percentage of the overall construction cost, therefore these penalties on local jurisdictions for delays in permitting can be significant.

And the law is working. In St. Cloud, a suburb of Orlando, prior to the new law less than half of the permits were processed within 30 days or less. After it passed, that number jumped to 80%. It's amazing how we respond to incentives!

Source: FGA

So, despite looking like Richard Nixon had a baby with a bloated wood tick, this is a positive move by DeSantis for housing accountability.

Also, just last week Gainsville took from California's SB9 playbook and upzoned the entire city, allowing duplexes, triplexes, and fourplexes on any single-family home zoned lot. This was the first city in the state to make this type of upzoning move, and will likely not be the last.

Well done Florida...Keep those red tape-eating alligators coming!

Regulation Nation

In all, the reality that on average developers are spending 40% of their construction budget on regulatory requirements puts a stunning spotlight on the main blocker to more housing.

All of these regulatory costs placed on developers have several unintended outcomes. First, it increases rent as the cost of total construction is higher. Second, it delays construction which continues to strain the badly needed supply. Finally, it discourages purpose-built affordable housing with below-market rents because the economics of such a build gets unreasonable as the financial burdens on developers increase.

The study concludes that:

Although smart regulations can play an important role in ensuring the health and well-being of the American public, our new research found that many regulations can go far beyond those important goals and impose costly mandates on developers that drive housing costs higher.

So What? Regulations play a critical role in protecting consumers, the environment, and discouraging unethical and criminal behaviors. That said, too many regulations can also have damaging effects on consumers and society.

We need to deflate the cost of housing production starting with unnecessary and draconian regulations. By doing so, we will make more construction projects economically viable, helping developers bring more supply to the market.

Weekly Real Estate Stories

🤯 Inflation Data: Moderated inflation has many thinking we have seen peak inflation. Let's hope...

📉 Mortgage: Demand is at its lowest level in over 22 years — CNBC

😟 Sentiment: From homeowners is at its lowest levels in over a decade — Fannie Mae (OK one more time...)

😟 Sentiment: From builders is now underwater — MPA

📉 Construction: Of new homes is down 9% month-over-month — Census

❌ Surprised? Canceled: 16% of home purchase contracts in July were canceled, the highest rate in over 2 years — Redfin

⚖️ Balance: Is being restored to the market giving buyers more control and time — Zillow

🪧I Won't Pay: Don't you wish you could just boycott your mortgage? In China, they are — Inman

Up next, on briefcase...

...Ayn Rand, Rand Paul, and Paul Ryan walk into a bar, the bartender serves them tainted alcohol because there are no regulations. They die.

Read the most-shared newsletters:

- 🔵 Double Double Toil and Bubble Trouble?

- 🥰 Love Song To YIMBYism

- 🏡 Missing Middle Housing

- 👮♂️Yes, Affordable Housing is Illegal

- 🎬Big Short 2: Supply Crunch

Written By Brad Cartier