From our CEO

Pacific Current Group (PAC) focuses on making minority investments in early to mid-sized investment management firms. Our area of specialization within the broad private equity world has now been dubbed “GP stakes” investing. This means that we focus on investing at the management company level of investment managers as opposed to investing in the strategies these firms manage.

The GP stakes world has grown exceptionally rapidly, with many new entrants and some dedicated GP stakes funds now exceeding $10b in size. The flood of interest and capital has created an interesting dynamic. With many mid and larger-sized investment management firms having now sold a minority interest in their companies, the pond in which many GP stakes managers are fishing is contracting. This is occurring at the same time as many GP stakes investors are raising ever larger funds to deploy capital into the same contracting universe.

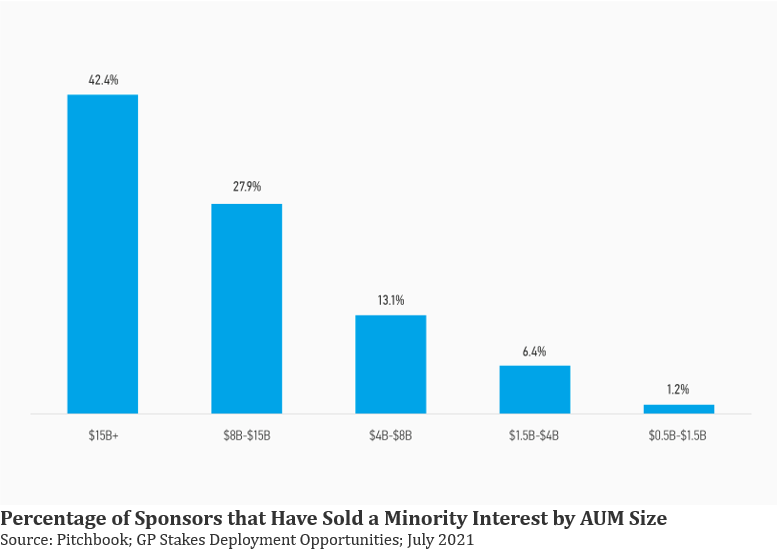

The table below illustrates how dramatically the opportunity for GP stakes investors has changed. It shows the proportion of private equity firms that have sold a minority interest in their firms based on total funds under management. For example, the 42.4% of private equity managers who manage at least $15b have sold a minority interest in their business.

PAC focuses on firms with assets under management that are typically less than $4b (the two bars on the right in the chart above), while the vast majority of capital raised in this space targets firms above this size (the three bars on the left). The result, in our estimation, is an “oversupply” of capital, which creates exactly what one would expect – growing valuations for larger transactions.

Because most transactions in this industry are between private companies, there is not much publicly available information to support our contention of inflated valuations. However, based on offers received by our portfolio companies and our daily conversations with a broad array of industry contacts, we are confident in saying that valuations have expanded significantly over the last five years or so. Indeed, it appears to us that many equity investors are effectively underwriting GP stakes investments to single-digit expected returns, although we are certain that they would disagree with this contention and justify the investments based on growth assumptions far more aggressive than ours.

For better or worse, our focus on small to mid-sized boutique investments has shielded us from most of the valuation pressures felt by firms targeting larger investments than PAC. By our estimation, our universe of potential investments exceeds 6,000 firms and continues to grow. On average, these companies are somewhat riskier because they are smaller, but we find that (1) many have exceptional growth potential, (2) we can more readily secure risk-mitigating features when investing in these firms, (3) our involvement can be quite impactful in improving their growth trajectories, and (4) they are often just one or two new funds away from being attractive to the larger GP stakes investors, who are inclined to pay valuations notably higher than we would ever consider.

This last point is worth expanding on. When we invest, we typically invest at EBITDA multiples in the 8x – 12x range and our intention is to hold our investments forever. Increasingly it appears that when our boutiques successfully raise a larger fund, that success attracts the interest of larger GP stakes investors willing to pay EBITDA multiples more like 15x – 20x. If our portfolio company is inclined to accept the offer, we will find that we have essentially engaged in an arbitrage. When this occurs, it should be extremely rewarding for PAC, though it certainly won’t happen with every investment.

We had one small liquidity event last year when we sold part of our investment in Proterra Investment Partners at a very attractive valuation (more than 40x pre-tax profits). We continue to believe that additional portfolio liquidity events are possible, though definitely not certain. If any such developments occur, we expect them to be consistent with the market dynamics discussed here.

Paul Greenwood, CEO & CIO

|