From our CEO

As all Pacific Current Group (PAC) shareholders are aware, PAC recently approved a transaction whereby it would sell three portfolio assets to GQG Partners, while also externalizing the management of the remaining PAC portfolio. This plan was voted on at an EGM held on 19 April 2024.

The finalization of this transaction marks the end of an era. It means the business that was created out of merger of Treasury Group and Northern Lights Capital Group in 2014 will look different going forward. Given that this will be my last quarterly From Our CEO memo for PAC, I thought it would be a good time to reflect on the investments we have made since late 2014.

Before the merger both Northern Lights and Treasury Group had been constrained to doing small, venture capital like investments in the asset management space. These were typically $1m to $5m and like all venture investments resulted in a broad distribution of outcomes.

After the merger we were able to significantly increase the size of the investments we made as a result of several large liquidity events, (including the disposal of interests by the merged group in IML, RARE, and Aperio), a couple of equity raisings and a new debt facility. While PAC has continued to invest a modest amount in earlier stage investments, most of our capital has been deployed into investments in the US$20m to US$40m range.

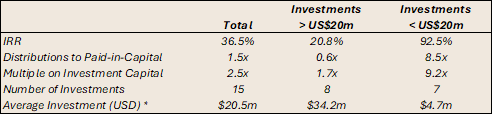

Like any investment track record, the performance of our individual results varies across the portfolio. We are proud of our successes and humbled by those investments that failed to meet our expectations. We believe the company has been the beneficiary of both good luck and bad luck, though it is impossible to know how much of either. In aggregate, we feel good about the returns on the investments made since 2014. With an estimated gross IRR of 36.5% (as of 31 March 2024), our results have meaningfully exceeded our desired objective of producing a 20% IRR across all the capital we have deployed.

Before delving into the results, please note the following caveats and clarifying comments:

• It should always go without saying, but past performance is not a predictor of future results.

• The performance metrics are all gross of management fees. This is because PAC has invested from its balance sheet and not through a traditional private equity fund structure that charges an explicit management fee.

• The valuations we use are PAC’s assessments of fair value. PAC calculates this figure every six months. For all of our equity accounted investments the statutory value may be different than our fair value estimate. This is because for statutory reporting purposes our equity accounted investments can only be written down and not up. All valuations are audited annually by Ernst and Young and reviewed semi-annually by valuation firm, Leadenhall.

• The accounting standards require us to value our investments from a “value in use” perspective. In other words, we assume the portfolio company is valued as if each company continues to operate in a business-as-usual mode. In some circumstances this can understate valuations because (1) in situations where a company decides to sell some or all of its business, we don’t take the market feedback we receive into consideration for our valuations unless there is a signed term sheet in place, and (2) they ignore certain economic features in our investments like “liquidation preferences,” which provide us with disproportionate proceeds in the situation where assets are sold.

• The metrics were calculated as of 31 March, 2024. We note our valuations are performed on a semi-annually, thus we are applying 31 December 2023 valuations for these calculations. The only differences in inputs into the calculation at these dates were the cash flows received during the first quarter and the sale of PAC’s interest in GQG. The IRR calculated on the portfolio as at 31 December was a very similar 37.9%.

• We attempt to draw inferences from performance in a very cautious manner. This means that investment results are best observed over time to develop an appreciation for the amount of “noise” (valuation volatility unrelated to the fundamental performance of the business) that finds its way into valuations and related metrics.

Summary statistics related to the capital we have deployed into investment firms post 2014 include the following:

• Capital deployed: US$293.8m (US$289.2m in equity and $4.6 debt). This excludes deferred consideration and earnouts not yet earned

• Number of investments: 15 (13 new investments and 2 follow on investments)

• Number of exits: 4 full and 1 partial (excluding the 3 assets being sold to GQG)

• Largest Investment: US$70m (Victory Park Capital)

• Smallest Investment: US$625k (SCI)

• Highest IRR: 136% (GQG)

• Lowest IRR: -100% (CAMG)

• Highest Multiple: 99.2x (GQG)

• Lowest Multiple: 0x (CAMG)

* We use US$28m for the value of the Avante investment, which includes US$15m already invested, plus $13m of deferred consideration

Observations

Upon reflecting on the results above I am struck with how similar actual results have aligned with what we would expect theoretically. Specifically, our smaller, earlier stage investments have had a much broader distribution of outcomes than our larger investments, with some exceptional successes like GQG (99.2x return on US$2.7m) and SCI (10.6x on a US$625k investment), whereas with CAMG we lost our entire US$5.6m investment.

The larger investments of at least US$20m have thus far produced an IRR slightly above 20%, which on average, is the return we are underwriting these investments to. Many of these investments have current IRRs in the 20% range, though we have experienced both positive (Aperio) and negative (Banner Oak) outliers.

Summary

Rajiv Jain of GQG Partners is fond of saying that “knowledge is cumulative.” We certainly agree. When we look at the investments we have made since 2014 we can see how we have applied the many lessons we have learned to make subsequent investments better, albeit never perfect. Given that investing can never be mastered but only improved, a major objective of investing is to make sure you are making new mistakes and not repeating old ones. As we go forward into this next chapter we are as excited as ever to apply our cumulative experience and knowledge to the opportunities that await us, including the opportunity to make new mistakes.

In closing, I would like to thank the PAC shareholders for their patience, support, questions, and critiques. I must also acknowledge the talented PAC employees and board, without which these results would not have been possible. While things will be different going forward, I am confident that PAC shareholders will be well served by its new strategy.

Paul Greenwood, CEO & CIO

|